The United States confronts the reality of much slower growth in the coming years due to its massive accumulation of debt worsened by a huge drop in corporate income taxes because of president Donald Trump's tax cuts announced December 2017

American economists said the escalating debt levels are also pushing borrowing costs higher. The Department of the Treasury on Aug. 1 said total U.S. debt has exceeded $21.3 trillion, of which $15.6 trillion is owed by the federal government.

To combat this troubling rise, Treasury on the same day announced an increase in the size of its auctions to help pay for the ballooning federal budget deficit. It will add $1 billion each to auctions of 2-, 3- and 5-year debt over the next three months.

It will then add $1 billion each for 7- and 10-year note and 30-year bond auctions in August. Treasury will also issue a new two-month note to help assure liquidity in the fixed income market. The interventions will add $30 billion to Treasury's debt issuance for the third quarter. Overall, Treasury said it expects to borrow $769 billion in the second half of the year, up 63 percent from 2017.

Markets quickly reacted to the depressing news, with 30-year bond yields exceeding three percent for the first time in nearly two months. Experts noted this is a stunning reminder the federal government's skyrocketing debt is getting much bigger, and will start influencing interest probably within the year.

When Trump signed the Tax Cuts and Jobs Act of 2017 into law in December 2017, he boasted economic growth will erase the projected mammoth shortfalls from tax cuts and spending increases. Early results belie this claim, said, economists.

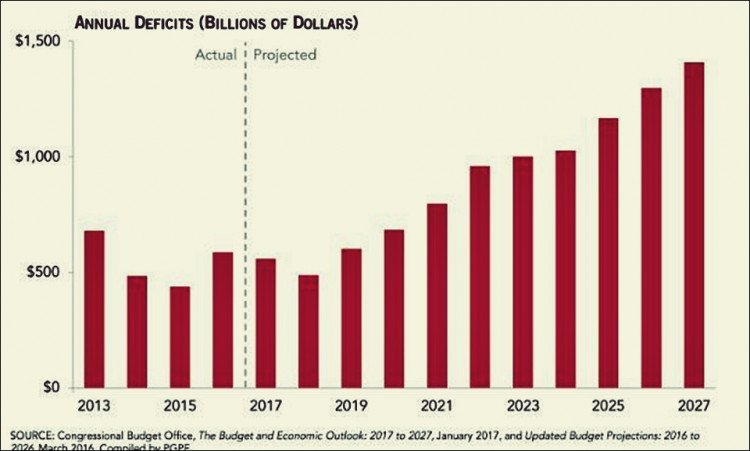

Trump was warned of this problem beforehand, however. In a report, last March, the Congressional Budget Office (CBO) said Trump's twin tax and spending bills will push the budget deficit to $804 billion this year and close to $1 trillion for the upcoming 2019budget year. The federal deficit will exceed $1 trillion in 2020 and $1.5 trillion by 2028.

The cost to finance this incredible mountain of debt continues to expand. It came to $458 billion in fiscal 2017 and is already at $415 billion in 2018 with three months left in the fiscal year. Revenue receipts are falling, thanks to the tax cuts that enormously benefit business.

Tax and withholding payments from individuals and corporations will amount to $1.8 trillion in 2018, a $17 billion drop year-on-year. That's also below the 0.2 percent gain in revenues the government projected.

Experts say these negative factors raise questions about how long the temporary boost in economic growth will last, what will happen the next time the economy falls into recession.