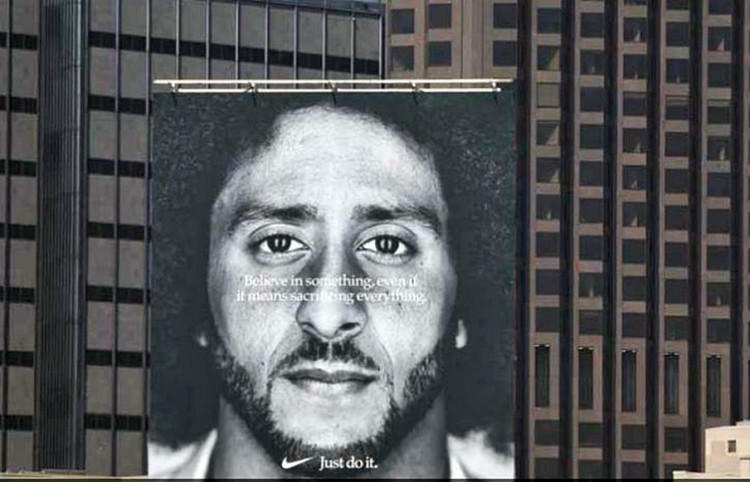

After its shares hit an all-time, intraday high of $86.04 on Sept. 21, mainly on account of the fantastic success of the Kolin Kaepernick ad campaign launched early this month, Nike's sales slipped four percent Tuesday, but analysts aren't blaming Kaepernick for the retreat.

The four percent drop came after Nike yesterday reported earnings slightly better than analysts' forecasts.

Nike's revenue for its fiscal first quarter ending Aug. 31 improved 10 percent to $9.95 billion, which was $10 million higher than the consensus forecast among Wall Street analysts. Nike posted earnings of $0.67 a share in the quarter, beating the Wall Street figure by $0.04.

The numbers show it definitely a strong quarter, if not a blowout one for the sports gear maker. But investors reacted to the good news by abandoning Nike's stock. Why?

It's not because of Kaepernick, said analysts, because his ad campaign began early September and the earnings period that saw the four percent drop in sales ended on Aug. 31.

The reason for the sales decline is laughable, said, analysts. It's mainly because of "success fatigue."

Nike's stock jumped six percent since the company announced the Kaepernick endorsement. This announcement was followed by a series of record highs this month that added a massive $6 billion to Nike's market cap.

This development, however, made Nike a very expensive stock. As of Sept. 25, Nike traded at 72 times its recent earnings. Nike also has a record track record of beating analyst estimates.

Nike has now beaten analyst forecasts for 25 straight quarters, according to research firm Bespoke Investment Group based in New York. Bespoke said last time Nike missed its forecast was in June 2012, which was a few months before Kaepernick scored his first career touchdown for the San Francisco 49ers.

This run of success, however, is spoiling investors who have come to expect Nike to beat earnings forecasts every time. This being the case, a mediocre quarter can turn out to be a disappointment.

But there were some so-so numbers for the quarter ending in August. Sales in Europe, Asia, and Latin America, which together account for 58 percent of Nike's revenue, were mixed. Nike's gross margins of 44 percent were lower than some projections. This might hit at a rise in production costs.

The all-time high on Sept. 21 saw Nike's shares rise nearly 60 percent year-on-year. Nike has a market cap of $135.6 billion.