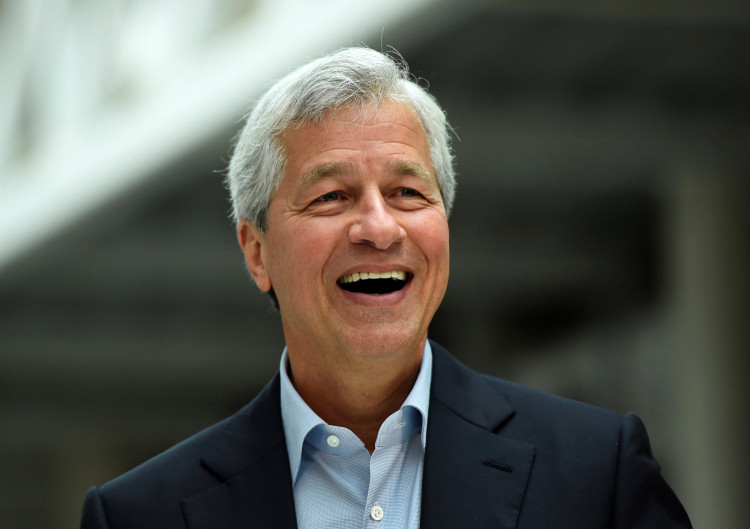

The ongoing trade war between two of the world's biggest economies has not only hurt their own markets but also smaller markets that rely on them for trade. Recently, J.P. Morgan Chief Executive Officer Jamie Dimon slammed the United States President Donald Trump's decision to engage China in a bitter trade war. Mr. Dimon said that the trade war will bring a huge problem for American companies.

Mr. Dimon said that while the price increase brought by tariffs against various goods would be detrimental, the trade war will pose a much bigger problem which is the second-order effects. Because of this, Mr. Dimon said, a business can opt to delay their capital investments or, even worse, move its manufacturing outside of the United States in order to counter the devastating effects of the trade war. This, according to him, will have massive negative effects on the overall economic growth of the U.S.

The United States initially imposed a $50 billion tariff on various goods. On top of this, President Trump decided to add another $200 billion tariff recently. Mr. Dimon said that problems with regards to retaliatory tariffs are not limited to the direct cost increases.

During an interview, Mr. Dimon highlighted that while these trade tariffs are already a burden to American consumers, the real danger lurks behind. He described this danger as the possible response of various companies to increase production cost brought upon by the trade war.

By imposing massive tariffs on various goods, including raw materials, the trade war is seriously damaging the supply lines. Mr. Dimon believes that as companies start to reduce investments or start moving their supply chain from somewhere else, this could seriously his the U.S. economy.

The CEO said that while the direct effect of these trade tariffs is higher production cost for businesses and higher prices for consumers, it is the tariffs' second-order effects that alarm him the most.

In a recent survey released by Business Roundtable of 141 U.S. CEOs, it was revealed that roughly two-thirds of them believe that the trade war, especially the tariffs, will cause companies to reduce their capital spending.

More and more business are starting to feel the negative effects of the trade war. As confidence continues to dwindle, many market observers have noted that time will come that this business will ultimately shift their manufacturing outside of the United States in order to avoid the negative effects of the trade war. According to Mr. Dimon, this predicted exit of business poses a more legitimate threat to the U.S. economy compared to price increases.