China now has 13 banks with at least $500 billion in assets, much more than the number of such banks found in Japan and the United States combined. China is therefore now leading the world's Mega-Bank Club. Whether this is in line with what China wants or intends for its banking system, there is a report claiming that it is.

Mega banks are financial institutions described as too big to fail because of their massive amout of assets. After only a decade of imposing runaway credit expansion policies and loosening of regulations, the country's banking system has already more than quadrupled in size. Moreover, compared to any national banking system around the world, the Chinese banking system has more giant institutions. Whether having such a number is a good or a bad thing remains to be seen.

According to Bloomberg, China now has 13 banks with at least this amount in assets, which is much more than Japan and the US combined. They are also the financial institutions described as too big to fail. Whether this is in line with what China wants or intends for its banking system, there is a report claiming that it is.

According to key sources familiar with the subject, China wants to have more financial companies that are systematically important. This is one way for it to prevent a financial crisis from materializing given the swelling of its debts.

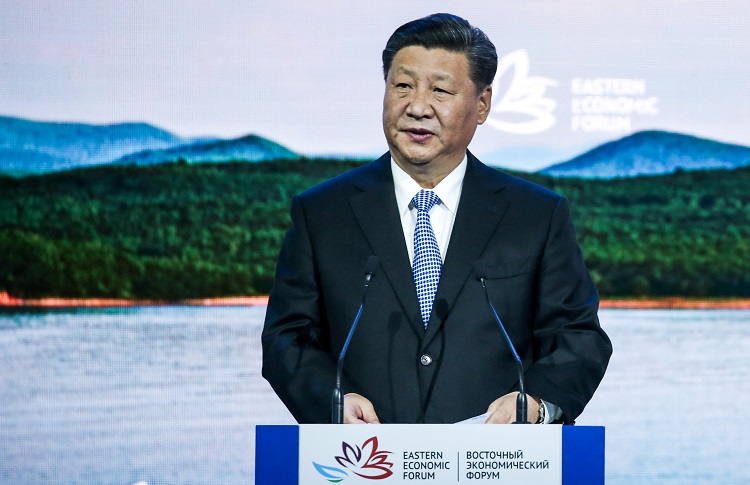

There is a belief that by increasing the number of "systematically important financial institutions," President Xi Jinping's government can solidify and strengthen how it manages China's financial system, valued at $40 trillion.

China is also doing all it can to ensure that its economy has enough credit to withstand pressures and threats, mainly because of the ongoing trade war with the United States.

According to an analyst based in Shanghai, employed at Capital Securities Corp., Liao Chenkai, China's regulators "China's regulators are indeed trying hard to avoid financial risk as credit levels remain very high,", as reported by Bloomberg. Increasing the number of banks too big to fail is in line with this overall effort since this could heighten the nation's capital position.

Apart from increasing the number of mega-banks, China also recently said that it has a host of tools to survive the ongoing trade frictions with the United States. China's central bank governor Yi Gang claimed that at their disposal are several monetary instruments, including a sound interest rate policy and strong required reserves ratio, which they readily adjust when necessary if the war worsens.

Yi, however, claimed that China is still looking forward to a constructive solution to the trade issue. The frictions between the two economic giants are already affecting the confidence of global investors and worrying the other national economies.