Uber was reportedly told by major Wall Street banks that it could attain a valuation of $120 billion in a stock market floatation on the New York stock market the company planned in 2019.

Interestingly, Uber's intended initial public offering coincided with that of the timing of its main competition, Lyft.

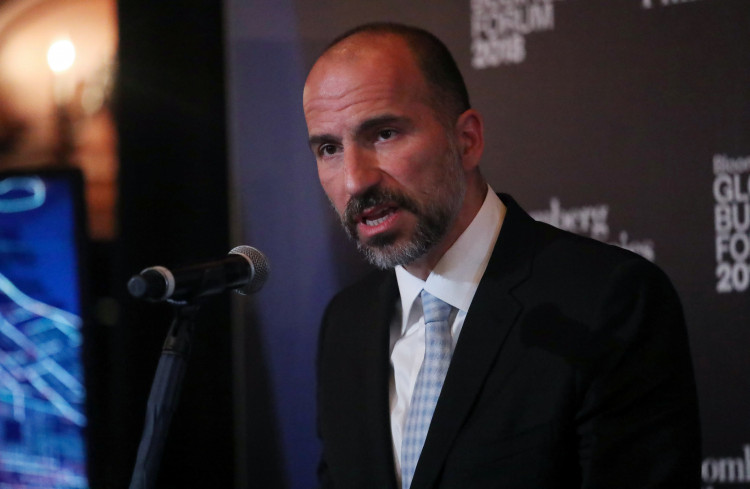

Morgan Stanley and Goldman Sachs Group have reportedly told Uber it should be aiming for a valuation of about $120 billion after Chief Executive Officer Dara Khosrowshahi announced Uber's plan of going public in the second half of 2019.

The information was first revealed by The Wall Street Journal on Tuesday, citing people familiar with the discussion.

The reported $120 billion valuation is higher than the $76 billion Uber raised in August. The value is, in fact, higher than the combined market values of General Motor Corporation, Ford Motors Corporation, and Fiat Chrysler Automobiles NV as noted by WSJ. It could surpass the $104 billion valuation that Facebook attained during its floatation in 2012.

Still, compared to the big players in the tech industry, Uber's intended valuation is far less than Apple and Amazon which both have achieved trillion-worth of valuations.

In line with this objective, Uber has increased the size of its debut bond offerings according to a report from Bloomberg. People with knowledge of the sale told the publication that orders for Uber's private placement have swelled.

Specifically, Uber placed final terms for the debt comprising a $1.5 billion portion of eight-year notes that were priced to yield 8 percent and $500 million of five-year notes that were priced to yield 8 percent, Bloomberg stated.

Meanwhile, Lyft has hired JP Morgan Chase to lead its planned IPO for early 2019, CNBC reported citing unnamed sources. The sources also revealed that Credit Suisse and Jefferies are involved as underwriters in a more junior role. If this floatation goes as intended, Uber's main rival could be valued $15 billion in the public markets.

Uber is believed to be at a difficult position with regard to the controversy surrounding the disappearance of Saudi journalist Jamal Khashoggi. The company was among the big institutions that have distanced themselves from the kingdom following allegations that it is behind the death of Khashoggi.

On Oct. 12, Khosrowshahi bowed out from a speaking engagement from a major investor event that was supposed to take place in Saudi Arabia. Observers said this has been a risky move for the company of which 14 percent was owned directly by the kingdom through the direct investment made via Japan's SoftBank. Furthermore, Saudi's sovereign public investment fund owns about 5 percent of Uber after a $3.5 billion investment sealed in 2016.