China is faced with external economic challenges but foreign interest in local assets is one key drive pushing yuan to sustain its buoyancy. The currency may be impacted by the developments in the international trade relations but direct foreign investments plus government monetary easing is delaying yuan's decline which could otherwise take place uncontrollably.

The Wall Street Journal reported that assets held by China's central bank and the country's other monetary authority have dropped $34 billion in October. The publication noted that this was the biggest monthly fall that happened since late 2016, adding that this indicated a "deteriorating" investment environment for the country within the last four months. WSJ added that China has also been undergoing "flatlining" trade earnings. With all these factors being taking in, yuan is under more pressure than ever before.

WSJ highlighted that foreign acquisitions of Chinese assets were increasing at $11 billion per month in June. The subsequent months, however, showed a dramatic slowdown in foreigners buying Chinese assets. In October, net investment outflow was only at $2.8 billion. It was almost close to zero in the third quarter, according to WSJ. It did not help that price gains in China's real estate market slowed done in September. Still, with the sustained foreign investments, even if it is declining as well, yuan is standing its ground.

On the other hand, Bloomberg reported that China-related stocks outperformed last week following reports that the U.S. President Donald Trump and Chinese President Xi Jinping engaged in optimistic discussions regarding trade tensions. More so, last month was the most that Chinese stocks rallied since 2016 after President Xi announced measures to support local private firms and cut personal income taxes.

Foreign investors have poured in more than $90 million to the X-trackers Harvest CSI 300 China A-Shares ETF on Monday, according to Bloomberg. This was the largest inflow since 2015. On Tuesday, investors delivered about $174 million more.

iShares MSCI China ETF has received a total of $408 million in inflows for October and will continue to receive an additional $90 million in November.

By Friday, more investors have brought in more than $167 million into the iShares China Large-Cap ETF and over $117 million of inflows into KraeShares CSI China Internet Fund.

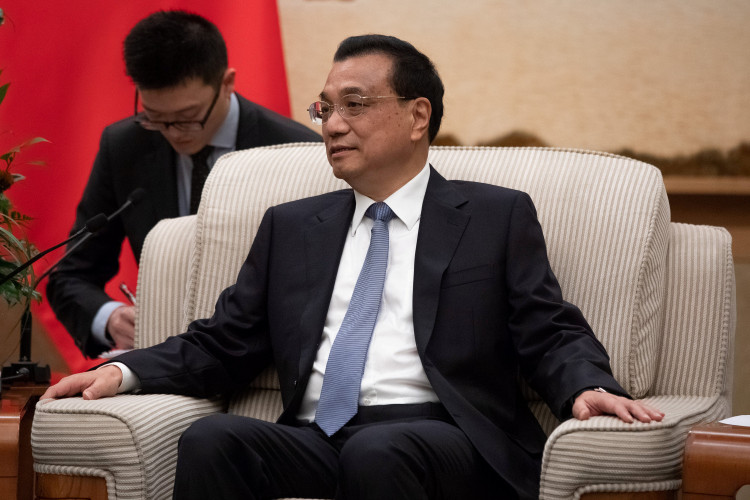

On Tuesday, Chinese Premier Li Keqiang said China will not end up resorting in competitive devaluation and will, in fact, maintain a stable and reasonable exchange rate for the local currency. Li said Beijing is confident that it can sustain resiliency even with mounting pressure on economic growth.

As previously reported by the Business Times, analysts from Japan-based trading firm Chiba Taiko Partners and San Francisco-based Matthews Asia concurred that Chinese shares are more attractive now after the country's central bank implemented measures aimed at easing monetary policies.