Philippines' Metropolitan Waterworks and Sewerage System (MWSS) and the Department of Finance (DOF) said on Wednesday during a press conference in Malacañang that there is no truth in the claim of a Japanese firm that the China-backed construction of the Kaliwa Dam will cost more than their proposal. MWSS Administrator Reynaldo Velasco said that it is not true that the Kaliwa Dam is too expensive and that it is worth $800 million.

Global Utility Development Corporation (GUDC), a Japanese firm said recently that the proposal of China to construct the dam will cost the Philippines $800 million. The firm also claimed that their proposal for the Kaliwa Intake weir project is estimated only at $410 million which is cheaper than the cost of China's proposal.

Velasco, however, said that China's proposal to build the Kaliwa Dam project will only cost $248 million which is cheaper than the proposal of GUDC. He said that the actual because it has been bided out already, is $248 million or P12.2 billion. The MWSS chief said that he has no idea where did the GUDC got their figures.

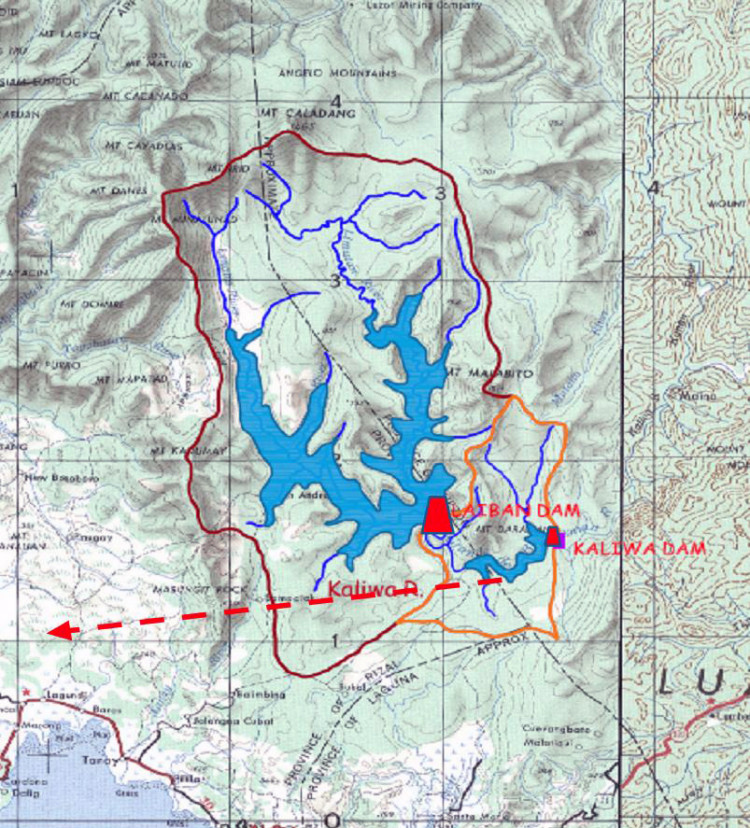

The DOF and the MWSS also argued the claim of the Japanese firm that building a weir is better suited than building a dam to provide water for Metro Manila and Rizal. They emphasized that a weir has no capacity to store water which is critical for days when there is a drought because it is shorter than the proposed Kaliwa Dam.

Tony Lambino, Finance Assistant Secretary, described a weir as a low dam which is dependent on the flow of water. He added that if the water flow is weak, it also weakens the capacity of the weir to provide water. Velasco also said that the design of the proposed China-funded dam includes a higher wall that will allow greater water storage capacity.

The Kaliwa Dam project will be funded through official development assistance (ODA) loan from China and not through a public-private partnership. Leni Robredo, the vice president of the Philippines, is among the most vocal critic of the move of the government to borrow from China emphasizing that a PPP scheme would not require the government to shell out any funds. Lambina defended the loan from China as he highlighted that China gave the Philippines a 2 percent rate which is cheaper than those offered by the multilateral development banks and private banks. Other critics fear the reputation of China to place other nations in a debt trap.