African governments are divided in their opinion on the use of blockchain and cryptocurrency in Africa. Reports said that Zimbabwe and Namibia have started to impose a hard stance on the use of the technologies while Mauritius believes in its economic benefits.

Africa is among the fastest growing continent in terms of the use of digital solutions for money transfers. The rapid growth in mobile telecommunication in the continent enabled it to surpass other many first world countries.

The use of mobile phones in the continent increased from 3 percent to 80 percent in less than 10 years and it brought with the increase in the number of local mobile and platforms for e-payment as African finds ways to ease the transfer of money across the continent.

Data showed that the second-highest population of unbanked adults in the world is in sub-Saharan Africa. The data reflected that about 350 million sub-Saharan Africans do not have a bank account. Data also showed that African nations have a dire need for remittance mechanisms aside from traditional banks.

According to reports, many African countries rely on foreign remittance as their main source of income.

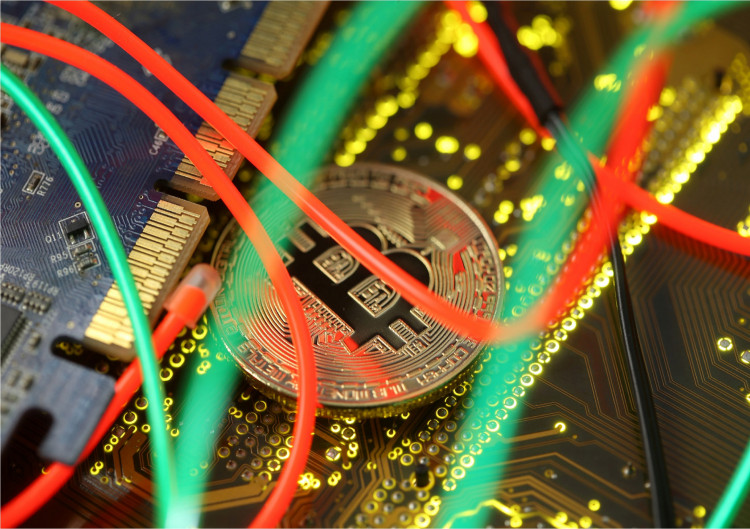

Africa is an ideal venue for new ways of monetary transactions. Baker McKenzie's Guide to Blockchain and Cryptocurrency in Africa said that Africans are divided into the use and regulation of blockchain and cryptocurrency. Some African nations seek to understand how to use the technologies while others are still speculating.

There are countries in Africa who are apprehensive and reserved in the use of the technologies. According to reports, Zimbabwe and Zambia started with a hard stance while Mauritius promotes the use of the techs. According to reports Mauritius created a regulatory sandbox that shows that they are taking a progressive take on the general benefits of the techs.

The Kenyan government recently established a task force to explore the use of digital currencies and artificial intelligence.

Kenya's National Land Commission started to use the blockchain network in creating transparency of land ownership in their belief that it might alleviate potential fraudulent sales of land and confusion over title to land.

Kenya also allowed the blockchain tech in its private sectors. Recently, the TMT Global Coin, a blockchain-powered logistics company, used blockchain technology to improve the transparency and authenticity of its records in imports and exports. Kenya also appointed a task force that will focus on cryptocurrency.

The central bank of Nigeria also plans to release its white paper on the use and regulation of cryptocurrency in the country.