Faraday Future, the embattled electric vehicle maker famous for its lavish promotions, receives another financial support following its dispute with Evergrande, its key investor. The company announced on Monday that it received $25 million in bridge financing which is part of a larger $1.25 billion capital increase that they plan to sign before the end of this year.

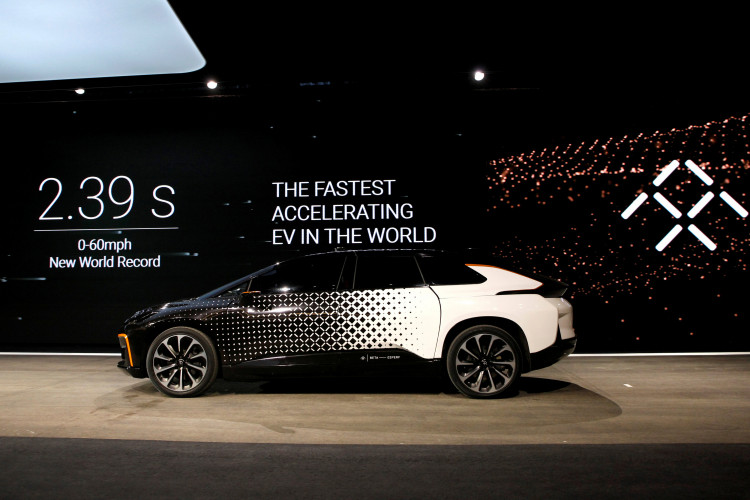

The latest investment was made by the United States asset management firm Birch Lake Associates. The investment is aimed at bringing the FF91 SUV, Faraday's flagship, back to the market. Part of the new lifeline received by the company seeks to reassure the suppliers of the company. Faraday is in turmoil since late last year. They also plant to obtain their commitments to ensure that the FF91 enters mass production. Faraday claimed that it had its intellectual property and technology valued to secure the financing. The company's technology is valued to be worth $1.25 billion.

The new financing is timely to the joint venture of Faraday with The9, a once-popular Chinese gaming company, which will bring the V9 EV to the Chinese market. The joint venture will give both sides 50-50 shares. Reports said that The9 invested $600 million in capital to secure its share.

Faraday said that it is expecting that the joint venture will produce 300,000 vehicles every year and is projected to sell the cars by 2020. Reports are also circulating that the company is in talks with EVAIO Blockchain for a possible $900 million in funding last November. There was no further news on the developments of the negotiation until now.

On Monday, the company said that it has a "growing fleet" of pre-production vehicles to test the features of its FF91. The company failed to mass produce the car model due to financial issues which forced it to lay off employees. The company also ended with unpaid wages, furloughs, property selloffs and much more. The company previously announced that they plan to start the mass production of the cars in 2018, which failed.

The financing troubles of the company started in 2017 followed by another crisis in 2018 due to the fallout with Evergrande, a Chinese real estate giant. Evergrande backed out of a proposed $2 billion investment deal with the company at the end of 2018 after a dispute on the terms of the deal. Faraday requested an advance on a future payment from Evergreen which was refused by the Chinese company.