NIO announced early Tuesday the resignation of its chief financial officer, Louis Hsieh. Due to a series of bad news, the stock is under pressure -- even before the CFO threw in the towel.

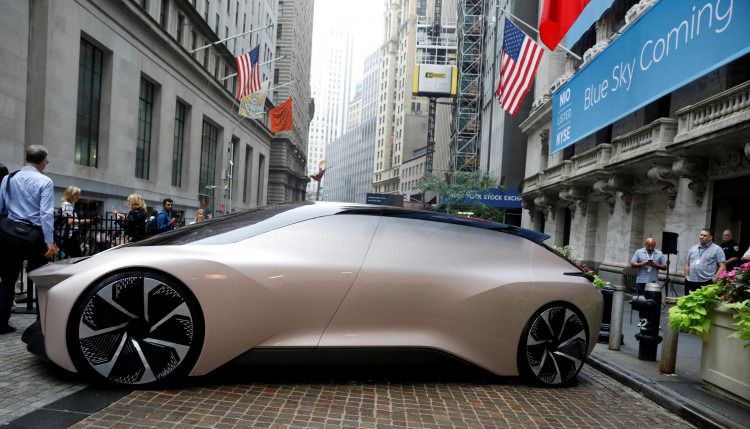

The company also said it began searching for Hsieh's replacement and is committed to "moving quickly to fill the role." NIO, a leader in the electric vehicle market in Asia, is the "Tesla of China."

For Hsieh's departure, the organization listed "personal reasons." Nevertheless, China's National Business Daily reported that "the sudden leave is likely to be related to the current funding policy of NIO."

A series of high-profile exits in the weakening conditions of the firm forced the stock down. NIO traded today with 4.6 percent losses.

The woes of NIO are still piling up. The company released its earnings for the second quarter in September, which were worse than anticipated.

However, the company's 2019 outlook did not meet the standards of analysts. Such company-specific factors and the decelerating electric vehicle demand in China also resulted in a huge stock sell-off.

NIO stock is trading down by 44 percent since its second-quarter results were released on September 24. The year-to-date losses of the company have risen to 75 percent.

NIO's battle for survival worsened after weak stock performances and inadequate direction. The cash-burn of the business became the central issue.

NIO stock has been downgraded by many analysts. On September 26, Morgan Stanley (MS) lowered the portfolio from "overweight" to "equal weight."

Also on the same day, Wolfe Research downgraded the company to "market perform" from "outperform." On October 4, Goldman Sachs (GS) downgraded NIO to "fair" from "invest."

The corporation has elevated its target price to $1.47 by 85 percent. But after its second-quarter results, it's not out of the forest yet for a detailed discussion of analyst scores for NIO.

Tesla, on the other side, seems to flourish in China. The firm has already started the development of test runs in China for its China-made Model 3s.

According to Piper Jaffray, Tesla's China revenues are growing. CNBC reported that Tesla's China deliveries increased in the third quarter by more than 175 percent compared to last year's same quarter. NIO's rivalry is likely to increase with the launch of Tesla's China Gigafactory.

Chinese automakers, particularly electric vehicle manufacturers, are struggling to generate profits with subsidies largely gone.

NIO is also facing a condition of a cash crunch. If the business does not communicate a viable income policy or tackle its money problems, the strain on the inventory is likely to continue.