By simply doing nothing at all, China's central bank helped spark a huge sell-off of maturing government debt.

The People's Bank of China has frustrated bond markets by missing open-market activities every day this week- essentially withdrawing from the financial system 560 billion yuan ($79 billion).

It also has misfooted bond bulls by not deploying a targeted one-year lending tool, despite the move that has been widely anticipated since last week.

The signal from Beijing to stimulus markets is no different from the tailored strategy that it has held throughout the year.

But this week's silence stands out when other central banks around the world are relaxing, with this year's Federal Reserve reducing rates for the third time on Wednesday.

Add in China's rising inflation and local authorities' imminent supply barrier- the outcome has been the worst downturn in sovereign bonds since March.

The Chinese central bank has shied away from inundating the market with cash partly because it remains aware of big debt pile-up risks and the country's still bubbly real estate sector," said Zhu Chaoping, an economist based in Shanghai at JPMorgan Asset Management.

"This has limited the space for further financial easing," said Nathan Chow, an economist at DBS Bank Hong Kong Ltd., concerned that more cash injections will not necessarily direct money into the actual economy.

Beijing, Chow said, will not want to flood markets with cheap funds and risk inflating a property market bubble.

In nearly two years, the spread between 10-year Chinese and U.S. government debt is approaching the widest. The difference allows yuan-denominated capital more valuable to international investors that might protect their tightly-managed yet weak currency.

Instead of relying on tools such as its daily liquidity operations and the reserve requirements of banks to free up funds, China chose not to follow the Fed on its latest easing path.

As part of its interest rate reform aimed at reducing borrowing costs, it introduced a new mortgage prime rate in August. But at the official lending rate, it still has to pull the trigger.

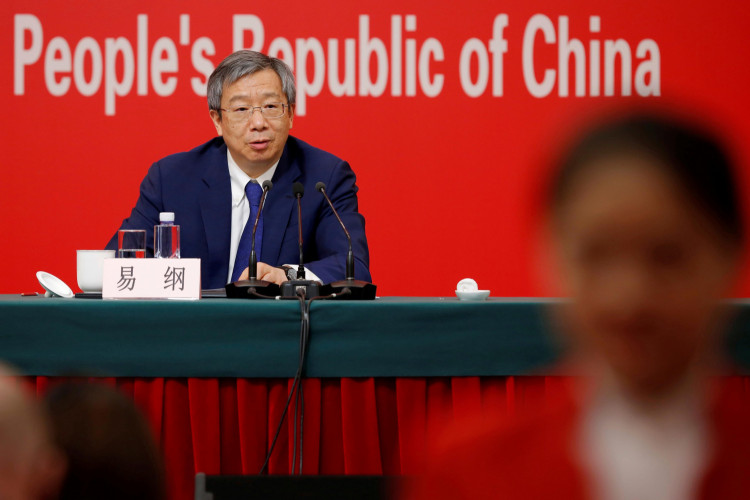

Chinese Central Bank governor Yi Guang said the government will continue to push for efforts to form a "prudent monetary policy" with measures being undertaken to ensure that the economy's financial supply and overall gross credit match with nominal inflation.

Investors may get fresh policy hints after the conclusion of the main four-day meeting of the Chinese Communist Party, where officials are supposed to negotiate the country's next five-year economic plan.

Statistics Thursday revealed a weakening forecast in October for China's manufacturing sector.

But for now, the threat is that in the reality of minimal liquidity injections, China's bond market is expected to continue its plunge. Since hitting a five-month peak this week, the 10-year yield fell Thursday.