China has made it a matter of honor to create its chip industry. But the burden of this 1.7 trillion yuan ($243 billion) endeavor may be too much for the country's debt-stressed veins.

Beijing has not hesitated over the past 10 years to mobilize its fiscal power to pursue economic and social goals. After the Lehman Brothers controversy in 2008, the government spent four trillion yuan building roads and railways to uplift the economy, sending growth into overdrive.

Authorities poured around 3.5 trillion yuan into shanty-town developments between 2015 and 2018 to help the marginalized. with fiscal spending turning into an urgent necessity.

Rising To The Challenge

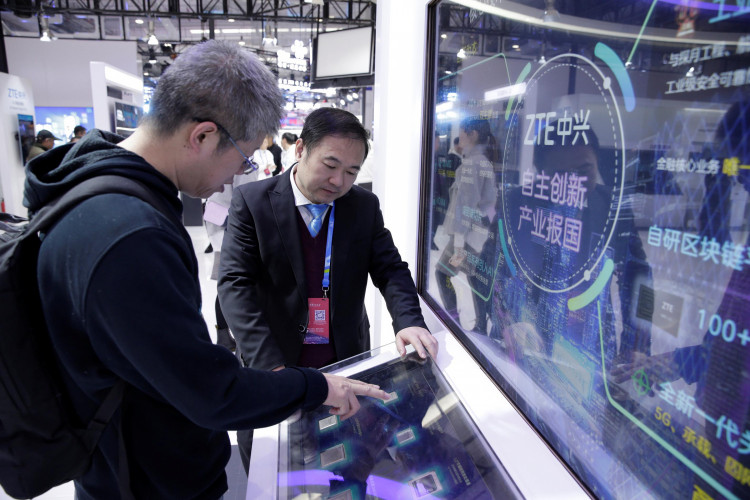

China has become more eager to build its 5G, artificial intelligence and chip technology with its national champions ZTE Corp. and Huawei Technology Co. pressured by U.S. sanctions.

More than 50 large-scale semiconductor projects have emerged across the country, with Caixin's estimates of a total of 1.7 trillion yuan of investment pledged.

A large number of these multibillion-dollar ventures will be supported by the government. For example, the state owns 75 percent of the equity in Yangtze Memory Technologies Co, which is controlled by Tsinghua Unigroup Co., the business unit of Tsinghua University, Chinese leader Xi Jinping's alma mater.

The NAND storage technology from Yangtze Storage shows huge potential and is only half a generation behind the world's leaders in flash memory. Huawei's subsidiary HiSilicon, on the other hand, is seen as a leading smartphone design house.

These positive cases, however, are too few and far between. For too little reward, it's mostly too much effort elsewhere. China's chip manufacturing technology is three to five years behind the world's leading contract manufacturer, Taiwan Semiconductor Manufacturing Co., and the country is sub-scale in assembly and testing, industry experts say.

Financial Firepower A Must

In the meantime, there are economic gaps. After the government refused to cough up more money, a Caixin investigation found that a 4.5-billion chip park in eastern China has ground to a halt. Another industrial park in Wuhan's central city had a court frozen the land-use rights due to financial difficulties.

Chip manufacturing is a very highly-stacked and costly business, as Korean and Taiwanese industry bigwigs know. For instance, during the last half-decade, Samsung Electronics Co. has allotted $25 billion annually in capital expenditures.

Credit Suisse Group AG estimates that to become globally competitive, Chinese chip park needs to shell out around $60 billion to $80 billion on software and hardware to be at par with the world's biggest tech players.