A broad barometer of Asian equity markets climbed to the highest in 18 months as Chinese equities increased, while oil hovered nearly three-month highs over a mix of U.S. crude inventory drawdowns.

MSCI's main Asia-Pacific share index outside Japan was last up 0.2 percent, shifting from a previous loss. After June 19, the index has risen to its highest.

Chinese blue chips, which had begun the day lower, grew 1.24 percent at mid-day break, supported by a study that retail sales are expected to rise 8 percent in 2019 and hopes that a new benchmark for floating-rate loans could minimize borrowing costs and fuel flagging economic growth.

Yet, as investors continued to accumulate recent gains, Australian shares remained down 0.44 percent. Japan's Nikkei stock index dropped by 0.57 percent.

Easing trade war discord and decreasing confusion about the United Kingdom's plans to exitg the European Union after British elections returned a strong Conservative majority this month gave a boost to global equities, helping the large MSCI Asia index to rally more than 6 percent and putting it on track for its best month since January.

Kay Van-Petersen, global macro-strategist at Saxo Capital Markets, said that reduced liquidity near the end of the year and the alleviation of China-US trade and Brexit uncertainties "have left us floating higher. So, even if there's a pullback, we do not think it is going to be significant."

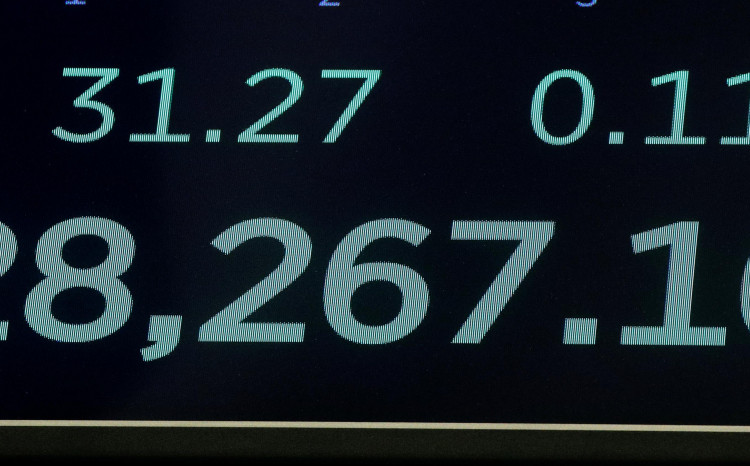

With the S&P 500 and the Dow Jones Industrial Average closing at new peaks on Friday, Asian equity markets benefited late last week.

The Dow Jones ended up 0.08 percent higher and the S&P edged up to 3,240.03 just 0.10 points. At the close, the Nasdaq Composite lost steam, falling to 9,006.63 by 0.18 percent.

Oil also rose on Friday, with prices reporting theithe r fourth consecutive weekly rise in three months to stabilize around their peak.

Brent crude's global benchmark rose 0.18 percent to $68.28 a barrel on Monday, while the U.S. West Texas Intermediate crude gained 0.05 percent to $61.75, which reversed a fall earlier.

Oil's gains followed reports of U.S. air strikes against Kataib Hezbollah, a militia group supported by Iran, in Iraq and Syria. U.S. officials said the attacks were successful on Sunday, but warned that there may be "additional actions" to defend U.S. interests.

Meanwhile, AxiTrader strategist Stephen Innes said the increase in U.S. shale oil production would outweigh any geopolitical risks, as Iraq's oil ministry disclosed that the halting of oil production at the country's southern oilfield by protestors would not affect their exports and operations.