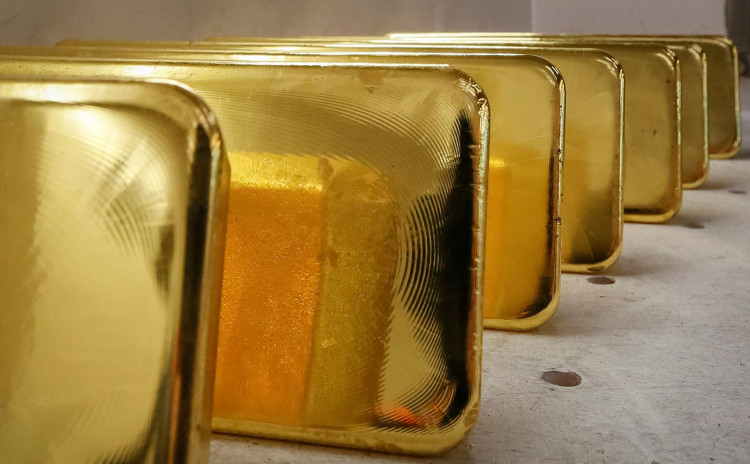

Gold prices dropped over 1 percent on Tuesday, prolonging losses from the meltdown of the previous day, as investors continued to sell the yellow metal to keep their capital in cash due to heightened worries about the coronavirus outbreak's economic cost.

Gold retreated to $1,490 a troy ounce to their lowest since August, as more and more investors have been forced to liquidate positions elsewhere in their portfolios because of liquidity stress.

During times of uncertainty on the global capital markets, gold is usually seen as a safe haven. But the recent sharp fall in its prices was due to cash flight in the midst of heightened market uncertainty.

Until paring returns, autocatalyst metals platinum and palladium increased more than 5 percent each in early trading. The metals were the hardest affected in the free fall on Monday, since they are also called industrial metals.

Spot gold dropped 1.4 percent to $1,489.90 per ounce, having plummeted to its lowest since November 2019 on Monday as much as 5.1 percent. US gold futures fell 1.2 percent to $1,503.20. Silver futures did even worse, dropping 16.5 percent to $12.06 per ounce.

Weak momentum can continue as long as the prices remain below $1,535. Immediate help at $1470 is provided. However, to cause significant liquidation pressure, a close below the same is required. A quick switch over $1,545 will later push rates up higher.

Other industrial metals were down nearly 25 percent to their lowest point since 2002 on Monday, while gold slipped more than 5 percent as investors sold precious metals in return for cash after a second U.S. emergency rate cut had failed to quench concerns of coronavirus across markets.

After one of Wall Street's biggest one-day routes in history, Asian shares dropped in a topsy-turvy session as reports about the outbreak and its global economic impact whiplashed market sentiment. Holdings in the world's biggest gold-supported exchange-traded fund (ETF) SPDR Gold Trust dropped 0.3 percent to 929.84 tonnes late Monday.

In a surprising move Sunday, the U.S. Federal Reserve cut rates down to near zero to boost a rapidly disintegrating global economy. The swings came as financial markets appeared to open sharply lower, with futures contracting on all three main U.S. financial indices.

With volatility growing in the global financial markets - which should have been advantageous for the bullion - the central bank pressed the panic button and signaled worries over economic recovery, Stephen Innes, director for market planning at AxiCorp, said.