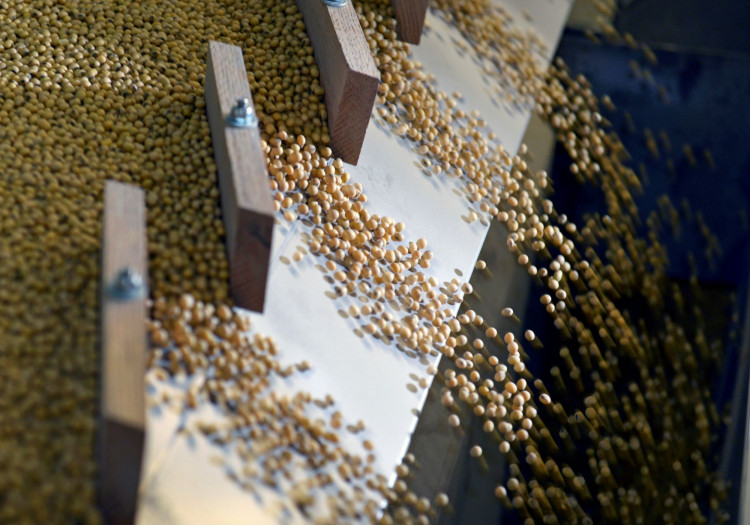

For the first two months of 2020, China's soybean imports from the United States have been increasing by 6 percent compared to the same period in 2019. Customs and data showed that cargoes booked during the trade truce between China and the US have also arrived.

China is the largest importer of oilseed worldwide and has bought 6.101 million tons of US soybeans in January and February of 2020. The shipments were still largely curbed because of the ongoing trade deal discrepancies between China and the US. Regardless, the imports were a part of China's commitments to the ordeal last December 2019.

It has increased its purchases by 3.09 million tons which is 44 times the level of imports in 2019. Chinese crushes have bought several rounds of purchases under the trade agreement last December 2018. During which, Beijing issued waivers to importers of soybeans exempting them from additional tariffs on some US cargoes.

Shipments of soybeans from Brazil, however, decreased by 26 percent. China only acquired 5.14 million tons as opposed to 6.916 million tons in 2019.

According to the General Administration of Customers, China's total soybean imports increased by 14.2 percent on a year-to-year basis. The total units of soybeans accounted for 13.51 million tons according to data released last March 7, 2020.

Despite the increases in imports, cargoes from the US are expected to fall in the remaining months of 2020. The Brazilian harvest entered the market in late February and early March. Hence, the Brazilian beans cost cheaper than US imports and offer better crush margins for Chinese mills resulting in expected declines in the following months.

Chinese buyers have also shown interest in buying more Brazilian beans to recover its low inventories faster. The pandemic has disrupted domestic production and the companies involved in the market are looking for a more affordable and feasible means to replenish their stocks.

In other news, Successful Farming reported that May soybean futures ended with a higher yield. They are 2.75 percent higher at 8.86 USD while July soybean futures closed two cents higher at 8.87 USD. May wheat futures, on the other hand, closed one cent lower at 5.61 USD.

Al Kluis of Kluis Advisors claimed that investors are focusing on ethanol production drops and that this would result in strike possibilities in South America. He said that many ethanol plants in the country are closing and that this shows a more downside risk compared to soybeans in the next two months.

He also added that watch cash basis bids for soybean futures and that the meal market is exploding higher as ethanol plants shut down. This would result in ta threat of a port strike in both Brazil and Argentina and affect its soybean prices.