General Electric anticipates to burn more money than estimated in the next three months, as the industrial giant deals with the extreme downturn in its aviation ventures because of the ongoing global health crisis, Chief Executive Larry Culp on Thursday disclosed.

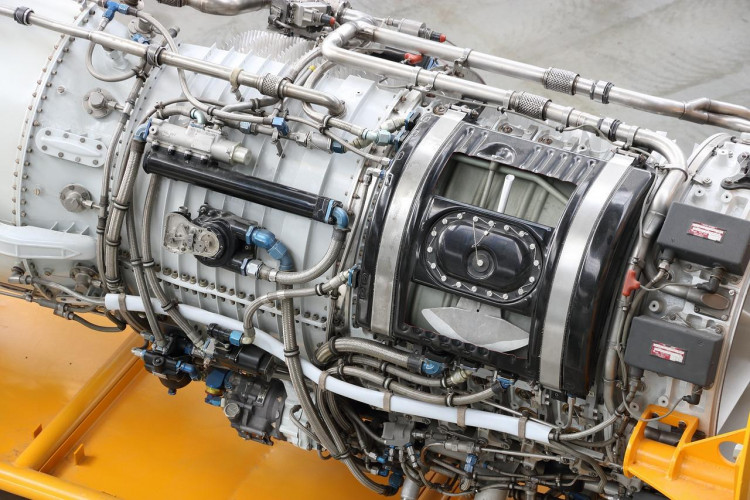

Stocks of the company, which manufactures aircraft engines and power facilities, dropped as much as 3.6 percent after Culp warned the group's free financial flow will be in the red territory this year.

The company's cash outflow for the second quarter is seen to range between $3.5 billion and $4.5 billion, Culp disclosed during a conference. This figure was larger compared to the average projection of a $2.5 billion outflow by analysts, Refnitiv IBES data showed.

Culp, the new boss, took over General Electric's vast asset portfolio 18 months ago and still has a lot of things to accomplish. Balance sheet worries at the company have been impacted by the sale of its healthcare division.

Proceeds from that sale buoyed GE's liquidity position by more than 20 percent in the first year of Culp's tenure, which should help cushion the company's negative free cash outflow in the coming months. Free cash will also further get a boost from the recently declared sale of GE's lighting unit.

GE was already being hounded by a bleak future as 2020 unfolded, and the coronavirus outbreak is only making things more difficult as the company treads along.

The industrial conglomerate welcomed 2020 in the early phase of a multi-year turnaround, looking to troubleshoot years of share-price retreats as a result of market-topping purchases and mounting debt issues.

GE is unloading a host of units to raise enough funds and settle off some of its financial obligations, but the crisis is causing new pain in places that GE expects to generate income from.

Based on official data, the total sales of GE was pegged at around $20.5 billion, a figure that was 8 percent lower compared to the previous year. The company's income from its industrial business for the given period was $1.1 billion, 45 percent less than its 2019 revenues.

GE's earnings per share gauge also declined significantly from 13 cents in the previous period to 5 cents in the first quarter this year, accounting for 61 percent drop. Also, its profit margins were down from nearly 10 percent to 5.7 percent, another huge challenge for the group's long-term sustainability.

Culp pointed out that the company's passenger aircraft engine installs would decline around 44 percent in the second quarter this year, with sales of aircraft components falling around 60 percent.