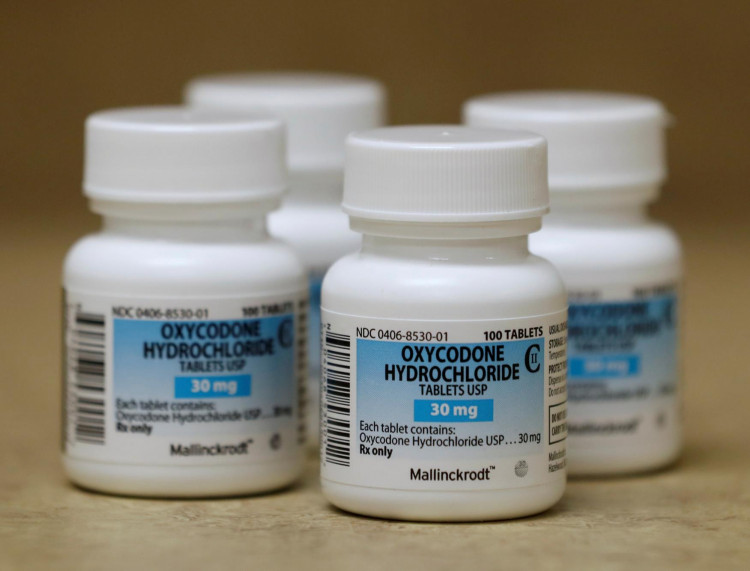

Drugmaker Mallinckrodt PLC says it has begun filing for a Chapter 11 bankruptcy in the U.S. as part of efforts to reorganize its operations and reduce debt.

The UK-based company becomes the third big opioid producer to seek bankruptcy protection after the company was flooded by claims it helped fuel the U.S. opioid epidemic, Bloomberg News reported.

Mallinckrodt in March lost a legal tussle to avoid paying rebates to the government's Medicaid programs for its top-selling drug.

The company said it had agreed to pay $1.6 billion in structured payments to settle opioid-related lawsuits. Around $450 million would be compensated as part of a settlement once Mallinckrodt completes its Chapter 11 filing.

Mallinckrodt said it was seeking to trim debt by around $1.3 billion and settle the opioid-related legal demand against it and its subsidiaries.

Opioid claimants would also be given warrants for almost 20% of its fully diluted outstanding shares, which can be sold or bought at a strike price that reflects total equity worth $1.5 billion.

The drug manufacturer will pay $260 million over a period of seven years to settle claims with Acthar Gel and restructure the Medicaid rebate computation effective July 1 this year.

Mallinckrodt, one of the biggest-volume opioid makers in the U.S. during the peak of the country's prescription drug crisis, received a Complete Response Letter from the Food and Drug Administration last month in relation to its marketing application for terlipressin for hepatorenal syndrome type 1.

Trading in company shares, which fell below $1 for the first time this month as investors retreated, was stopped at the opening bell Monday. Mallinckrodt stock hit more than $100 in late 2014.

In a filing with the U.S. Bankruptcy Court for the District of Delaware, Mallinckrodt listed both assets and liabilities of $1 billion and $10 billion, respectively.