A merger deal will take Boston-headquartered biology building company Ginkgo Bioworks public at a $17 billion equity valuation.

The deal, expected to occur in the third quarter this year, is seen to generate up to $2.5 billion in cash proceeds.

A synthetic biology pioneer, Ginkgo Bioworks will merge with Soaring Eagle Acquisition, a blank-check company founded by former Hollywood executive Harry Sloan, in a giant deal for SPAC companies on the NASDAQ, according to Forbes.

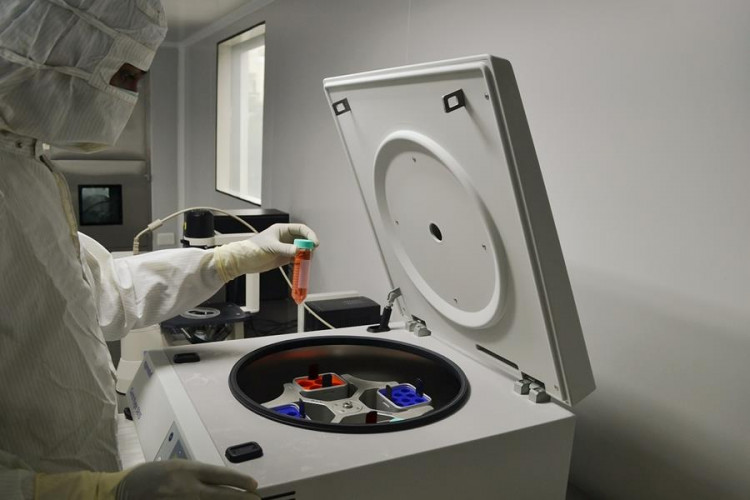

Ginkgo was launched in 2009 by a team of scientists from the Massachusetts Institute of Technology (MIT) intent on creating a so-called "made-to-order microbes" that enable customers to grow rather than make better products.

According to CNBC, Ginkgo Bioworks labels itself the "organism company" because it designs and prints DNA, the building blocks that support all living things.

Ginkgo is backed by Bill Gates' private investment company Cascade Investment, and was granted a $1.1 billion loan from the U.S. government in November for COVID-19 testing and production of raw materials for therapies to help address future health crises.

"It's a really fun time now, actually... COVID-19 has had a weird effect on biology awareness. Proteins are on the cover of The New York Times. My parents know what PCR is now. I think it's a really good moment to bring more of this into people's lives," Forbes quoted Ginkgo co-founder and chief executive Jason Kelly, as saying.

The large valuation the deal attaches to Ginkgo proves the increasing demand for bioengineered products and the biotech's place in that market as a provider of cell engineering technology.

Soaring Eagle, which raised $1.7 billion through an initial public offering in February, is led by executives of the same blank-check company that brought Skillz and DraftKings to the public markets last year.

"Blank check" companies are formed for the sole objective of acquiring another company, and taking it public, typically within two years.