The progressive independent senator from Vermont, Bernie Sanders, fought for the continuation of the Child Tax Credit to be included in the Inflation Reduction Act (IRA), but he also stated on Saturday that American families need more immediate assistance than the huge package would offer.

The American Rescue Plan (ARP) was passed by Democrats in March 2021 under the budget reconciliation procedure, enabling a party-line vote in the evenly divided Senate. With the passage of the law, the Child Tax Credit was enhanced to payments of $3,000 for children aged 6 to 17 and $3,600 for qualifying children under the age of 6.

ARP also changed how Americans were given credit. Millions of Americans received half of their anticipated credit as monthly payments of $300 for each child under age 6 and $250 for all other qualifying children, rather than receiving it all at once after filing their taxes.

The well-liked Child Tax Credit program, which many compared to the federal government's stimulus payments made at the height of the COVID-19 pandemic, was set to expire at the end of last year. Democrats attempted to revive the strategy through President Joe Biden's Build Back Better Act, but the legislation failed. Sanders planned to change that legislation to add an extension of the Child Tax Credit, but Democrats have now passed the IRA.

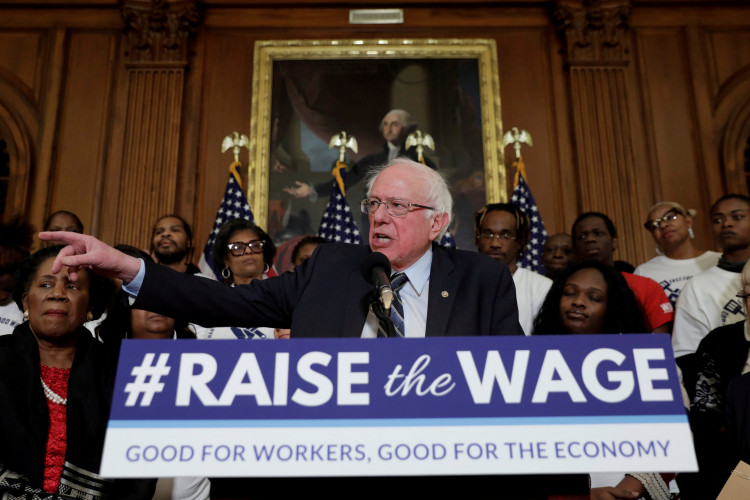

The Vermont progressive said in remarks from the Senate floor on Saturday, "I will be introducing an amendment to expand the $300 a month Child Tax Credit for the next 5 years paid for by restoring the top corporate tax rate from 21% to 28%."

Sanders' proposal was soundly defeated early on Sunday morning as senators continued to vote on modifications to the substantial package. A scheme that the majority of Democrats originally hailed as greatly reducing child poverty was defeated by a vote of 97 to 1 against the amendment to include the Child Tax Credit.

"In terms of our children, we have the highest rate of childhood poverty of almost every major nation on earth. This bill, as currently written, does nothing to address it," In his remarks on Saturday night, Sanders mentioned the IRA and urged other lawmakers to back his proposal.

Notably, Colorado Democrat Senator Michael Bennet had urged other party members to vote "no" on the amendment. Bennet has been a leading advocate for the increased benefit for parents, but he asserted that including the clause would destroy the IRA.

Although it presently seems doubtful that the federal government would increase the child tax credit or distribute more stimulus cheques in the near future, some states have taken the initiative to help their citizens.

Direct subsidies will be distributed in at least eight different states to assist struggling people and families. The amount of direct assistance varies from a few hundred dollars to sizeable payments for each dependent child and additional tax refunds on top of what families would typically receive.