More than a dozen Chinese-owned companies have declared that they had minimal or no exposure to Silicon Valley Bank, the collapsed U.S. lender that has caused widespread concern among investors and markets around the world.

Companies rushed from Sunday night into Monday morning to issue statements either detailing the scope of their risk or distancing themselves from the bank.

When asked about its financial stability, mobile advertising platform Mobvista Inc revealed it has $430,000 in deposit accounts with the bank, which is a small part of its total cash and cash equivalents.

A total of 3.9% of Beigene Ltd.'s total cash and cash equivalents were kept in uninsured cash deposits with the bank as of the most recent reporting date. It added that the events should not have any effect on business as usual.

Many companies, including CStone Pharmaceuticals, Noah Holdings Private Wealth and Asset Management Ltd, and Jacobio Pharmaceuticals Group Co, have reported having less than 0.2% to 0.5% of their cash on hand with SVB.

According to Broncus Holding Corporation, 6.5% of its total cash was stored in SVB, amounting to $11.8 million.

The largest percentage of cash and bank balances at SVB was disclosed by Brii Biosciences Limited, at less than 9%. It did not specify how much money was deposited.

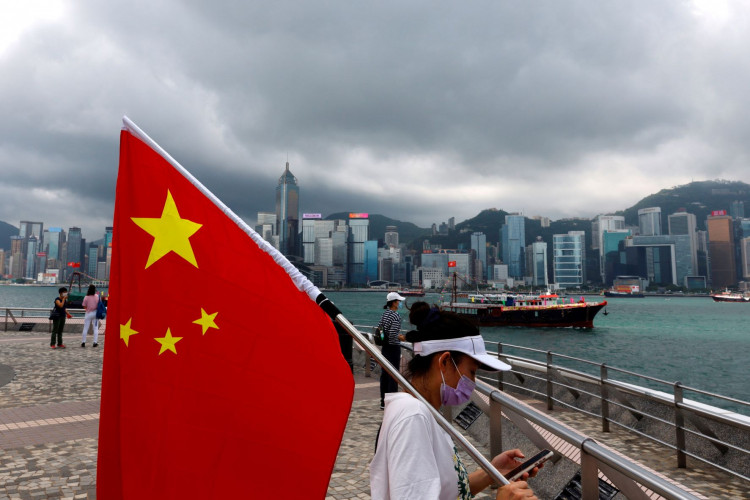

Many Chinese tech startups, notably those funded in U.S. dollars, have opened accounts with SVB, and the bank's failure has caused concern among its customers and investors.

SVB's Chinese joint venture with Shanghai Pudong Development Bank claimed Saturday to have a solid corporate structure and an independently controlled balance sheet.

Friday marked the greatest bank failure since the 2008 financial crisis, when SVB Financial Group, undertaking business as Silicon Valley Bank, failed. There will be no further financial fallout, as U.S. officials have stepped in to guarantee that all customers have access to their deposits beginning on Monday.

Before the collapse of SVB, the largest bank collapse in U.S. history was the 2008 failure of Washington Mutual (WaMu), which had assets of approximately $307 billion at the time of its collapse.

The failure of WaMu was a significant event in the 2008 financial crisis and resulted in the loss of billions of dollars for investors and taxpayers.

As the housing bubble began to burst in 2007, WaMu suffered significant losses on its mortgage investments. The bank's stock price began to plummet, and investors became concerned about its solvency. In September 2008, the Federal Deposit Insurance Corporation (FDIC) seized WaMu and sold its assets to JPMorgan Chase for $1.9 billion.