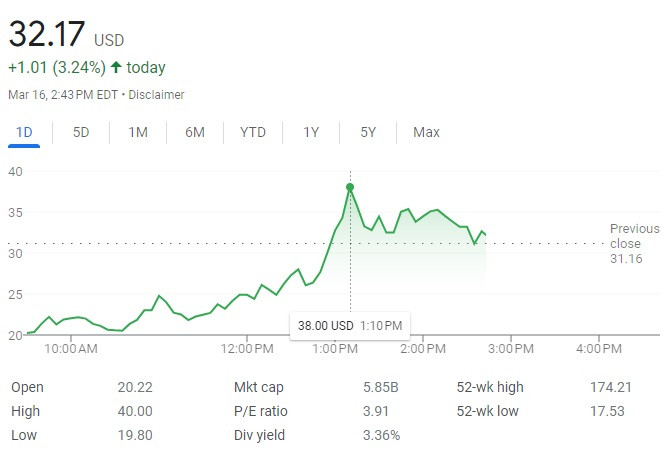

First Republic Bank, a prominent regional lender in the United States, has seen its shares jumped nearly 22% before trading was halted on Thursday as reports surfaced that the bank is exploring a potential sale while also engaging in discussions with major financial institutions about a substantial capital infusion. This development has helped assuage concerns about the stability of the banking sector and the bank's financial position.

According to sources familiar with the matter, First Republic Bank is said to be in early-stage discussions with several major financial institutions, including JPMorgan Chase, Bank of America, and Wells Fargo, about injecting approximately $20 billion into the bank. This capital infusion would be aimed at shoring up the bank's financial position and potentially averting a credit downgrade.

The potential sale of First Republic Bank comes as the lender faces mounting challenges, including a deteriorating loan portfolio and increased regulatory scrutiny. However, the bank's shares have rebounded in response to the reports of the possible capital injection, signaling investor confidence in the bank's ability to address its current challenges.

One industry analyst said, "The fact that First Republic Bank is exploring a sale and is in discussions with major financial institutions about a substantial capital infusion demonstrates that the bank is proactively addressing its financial headwinds."

The analyst added, "This development helps to alleviate concerns about the stability of the financial sector and the potential ripple effects across the industry."

As First Republic Bank navigates these challenges, the bank's management is reportedly considering a range of options, including selling off non-core assets, raising additional capital, and potentially merging with another financial institution. However, no final decisions have been made, and it remains to be seen what course of action the bank will ultimately take.

The potential capital infusion from major financial institutions appears to be having a positive impact on the bank's share price and the broader market. Some experts argue that this development could help to stabilize First Republic Bank and restore confidence in the banking sector.

"If the bank can secure the reported $20 billion in capital from major financial institutions, it could significantly strengthen its financial position and potentially avert a credit downgrade," said one banking analyst.

As the situation continues to unfold, investors and industry observers will be closely monitoring developments at First Republic Bank and assessing the potential implications for the broader financial sector. The bank's efforts to address its challenges and secure a stable future will likely have far-reaching consequences for the industry, making this a closely-watched story in the world of finance.