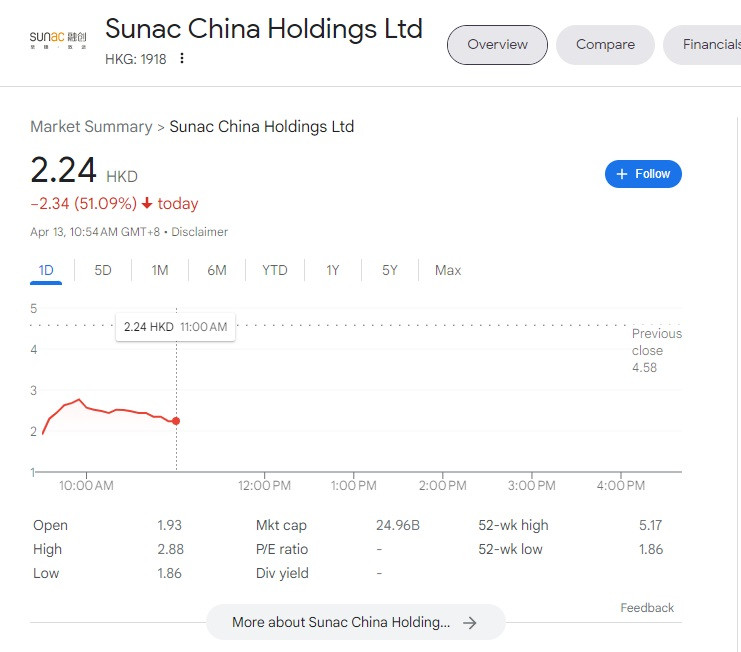

Sunac China Holdings Ltd, a Chinese property developer, saw its shares plummet by more than 50% on Thursday morning as trading resumed after a suspension lasting more than a year. The company is currently restructuring its debt following a default.

The decline in share prices occurred a day after Sunac announced its debt restructuring plan and intention to resume trading in a statement to the Hong Kong stock exchange.

Although shares fell nearly 60% in pre-market trading, they managed to recover some losses after the market opened. Steven Leung, a sales director at UOB Kay Hian, explained that "the stock was catching up with the decline in the property sector during the year of suspension." Leung also noted that the resumption of trading is a positive sign, as it suggests that Sunac meets the necessary criteria for trading resumption.

Sunac is among several Chinese developers that defaulted in 2021 amid a debt crisis in the property sector. Over the past two years, Chinese property firms have struggled to sell new homes or have had to sell them at lower prices than anticipated. Consequently, Beijing introduced supportive policies in late 2021.

In March, Sunac announced that it had reached agreements with a group of offshore creditors to convert its debt into new notes and convertible bonds, which are backed by its Hong Kong-listed shares and shares in its property management unit, Sunac Services. The company reported a core loss of 11.06 billion yuan ($1.61 billion) in its overdue 2022 interim results, published last month.

Yan Yuejin, an analyst at the E-house China Research and Development Institution in Shanghai, said that the property industry's recovery is uneven. While some developers, like Sunac and China Evergrande Group, have reached debt restructuring agreements, others face delisting. For instance, the Hong Kong stock exchange canceled the listing of Chinese developer Cinic Holdings earlier this month after it failed to meet trading resumption requirements within the specified time frame.