First Republic Bank's market value plummeted once more on Wednesday, with investors eagerly anticipating the bank's next move to potentially sell assets and orchestrate a turnaround without government aid.

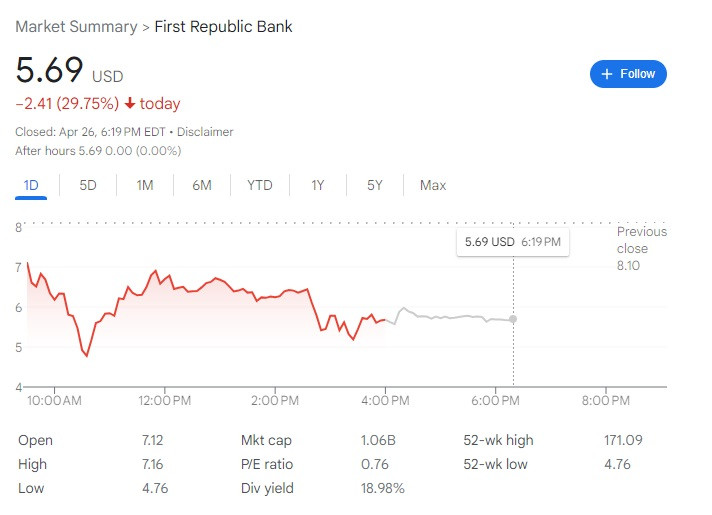

The bank's market capitalization nosedived by as much as 41% to roughly $888 million, dipping below $1 billion for the first time, a significant decline from its November 2021 peak of over $40 billion. It ultimately closed at around $1.1 billion.

A source informed Reuters on Tuesday that the bank is exploring various options, including asset sales or the establishment of a "bad bank" to isolate problematic financial assets. First Republic has announced plans to reduce its balance sheet and cut expenses.

At the height of the banking crisis on March 16, Wall Street banks temporarily deposited $30 billion at First Republic and have since been seeking viable options for the bank. JPMorgan proposed forming a consortium to purchase First Republic, but the idea failed to gain traction, according to two sources.

First Republic's advisers approached at least four of the 11 lenders involved in the temporary deposit with a proposal to acquire some of the bank's assets. However, three sources indicated they saw no viable path without government assistance.

U.S. government officials are currently not inclined to participate in First Republic's rescue process, as reported by CNBC on Wednesday. Bloomberg also reported that U.S. bank regulators are considering downgrading their private assessments of First Republic, potentially resulting in borrowing restrictions from the Federal Reserve.

Trading in First Republic's shares was halted multiple times, and the stock ultimately dropped nearly 30% to $5.66. First Republic declined to comment.

If the bank's balance sheet issues can be resolved, advisers have already identified potential buyers for new stock in the lender, according to a report earlier on Wednesday.

However, analysts identified several obstacles that could impede the San Francisco-based lender's rescue efforts as it attempts to recover from a first-quarter deposit outflow exceeding $100 billion.

David Wagner, portfolio manager at Aptus Capital Advisors, said, "The (First Republic) assets will be sold, but it may take some time and could be sold at a pretty severe discount to par."

Analysts noted that while First Republic's possible "bad bank" option differs from previous bad banks, the lender still has valuable assets such as well-performing mortgages. Christopher Wolfe, head of North American banks at Fitch Ratings, highlighted that the issue lies in the low interest rates rather than the assets themselves.

Wolfe also stated that creating a special purpose vehicle would necessitate buyers accepting a loss unless a price equal to or higher than the market value of the portfolio is agreed upon.

Three brokerages have reduced their price targets on First Republic's shares since the bank reported first-quarter earnings on Monday. B Riley Wealth's chief market strategist, Art Hogan, noted that First Republic's problems are likely unique, and the bank faces a difficult path ahead.

First Republic's results have renewed pressure on the banking sector following a series of regional bank earnings reports that initially reassured investors.