Nasdaq records the largest gain in nearly three weeks while Dow reaches a near two-month low. The semiconductor stock index rises nearly 7%, with Nvidia's market value approaching $1 trillion, almost double that of Intel's in a single day. Intel drops by 5.5%, leading the fall in Dow components. As concerns about debt default intensify, short-term US bonds due in early June see their yields break through 6.2% across the board. The market fully digests the Fed's anticipation of two 25-basis point hikes in future meetings, with the yield of two-year US bonds rising by more than 10 basis points during the session. The yield on two-year UK bonds rises by more than 40 basis points in two days. The US dollar index hits a new two-month high for three consecutive days.

Fitch's warning of a possible downgrade of the United States' AAA credit rating highlights concerns about debt default. Default risks loom large, with most US stock sectors continuing to tumble. However, unexpectedly strong AI demand and quarterly revenue and guidance far exceeding expectations have led to Nvidia's surge, propelling a full-scale rebound in semiconductor stocks and supporting a rise in Nasdaq and S&P 500.

Investor concerns over the U.S. government's potential inability to meet its obligations in early June are intensifying, with the bond market reflecting the ongoing risk of default. Yields on short-term U.S. debt due in early June have surged past 6.2% across the board.

Data released on Thursday were mixed: U.S. GDP growth for Q1 was revised upward, but the Fed's focus on PCE inflation for the quarter was unexpectedly revised upward to 5%. The number of people filing for unemployment benefits for the first time rose slightly last week, less than expected, but the numbers for the previous two weeks were revised down.

Following the data release, the market increased its bets on the Fed continuing to raise interest rates. Pricing shows that traders have fully absorbed the Fed's expectation of a 25 basis point hike during its next two meetings, with a more than 50% chance of a 25 basis point hike in June. The yield on the more rate-sensitive two-year US bonds rose by more than 10 basis points during the session, while the yield on benchmark 10-year US bonds both reached a two-month high.

European bond yields are also rising, with the yield on UK government bonds far ahead. After the UK's core CPI unexpectedly rose on Wednesday, reaching the highest growth rate in 31 years, the yield on two-year UK bonds rose nearly 20 basis points for at least one day in a row. When it continued to hit a seven-month high during Thursday's session, the two-day increase was more than 40 basis points.

In the currency market, as the market bets on the Fed continuing to raise interest rates, the dollar index continues to rise, standing above 104.00 for the first time in two months. Germany, the eurozone's largest economy, saw its GDP shrink by 0.3% quarter-on-quarter in Q1, contracting for two consecutive quarters and falling into a technical recession. The euro fell to a two-month low against the dollar, boosting the dollar's strength. The yuan was under pressure to fall, with the offshore yuan against the US dollar breaking 7.09 in mid-session for the first time since December last year.

In the commodities market, under the impact of the rising U.S. dollar and U.S. bond yields, gold continues to fall, closing below $1950 for the first time since late March. International crude oil hit a daily low, with the decline expanding to over 4% in the session after Russia's Deputy Prime Minister hinted that OPEC+ will not announce new production cut policies at its June meeting. With natural gas storage levels higher than usual and strong supply of liquified natural gas (LNG), the recession in Germany has hit European demand prospects, causing European natural gas prices to fall sharply, hitting a two-year low.

Nasdaq achieves its largest gain in nearly three weeks, with Nvidia's market value nearing the trillion-dollar mark, a day's gain almost equivalent to two Intels. Intel led the drop among Dow components.

All three major U.S. stock indices opened higher. The Nasdaq Composite Index rose over 1% at the opening and kept gains all day with the S&P 500. When it refreshed its daily high at the end of the session, the Nasdaq rose slightly over 2%, and the S&P rose over 1.2%. However, the Dow Jones Industrial Average quickly turned negative after the opening. When it refreshed its daily low at the end of the morning, it fell nearly 214 points, down nearly 0.7%, and then gradually narrowed most of the declines. Both midday and the end of the session saw brief turnarounds.

Ultimately, all three indices failed to rebound collectively. The Dow fell 35.27 points, down 0.11%, closing at 32764.65, down for five consecutive days, hitting a new closing low since March 29 for two consecutive days. Nasdaq rose 1.71%, marking its largest gain since May 5, when Apple announced its first-quarter earnings, closing at 12698.09. Not only did it move away from the lows of May 16 set by the two-day decline on Wednesday, but it also neared the highs set by Monday's rebound, which were the highest since August 18 of last year. S&P, which had refreshed its lows since May 16 of last week on Tuesday and Wednesday, rose 0.88%, closing at 4151.28.

The tech-heavy Nasdaq 100 rose 2.46%, outperforming the broader market, hitting the highest level since April of last year after falling for two consecutive days to a weekly low. The Russell 2000, which is mostly made up of value stocks, fell 0.7%, falling for three days in a row and hitting new lows since May 16 for two consecutive days, underperforming the broader market for two consecutive days.

Among the major sectors of the S&P 500, five rose on Thursday. The IT sector, where chip stocks are located, rose over 4%. Nvidia, a constituent stock, led the S&P 500. The communications services sector rose over 0.4%, and industrial and real estate sectors rose about 0.3%. Financials edged up. Of the six sectors that fell, the energy sector, which had risen against the market for two consecutive days, led the declines, falling about 1.9%. Utilities fell over 1%, and healthcare fell about 1%. The smallest decline was in materials, which fell nearly 0.4%.

Chip stocks, which had fallen for two consecutive days overall, rebounded strongly. The Philadelphia Semiconductor Index and the Semiconductor Industry ETF SOXX rose about 6.8% and 6.7%, respectively, both hitting new closing highs in over a year.

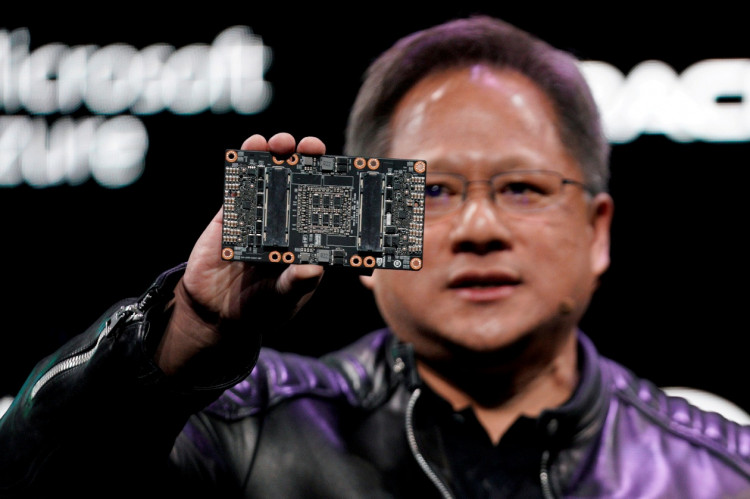

Among chip stocks, Nvidia gapped up more than 26% at the open. In the morning, the stock price had risen to $394.8, up more than 29%. It closed up 24.4%, slightly below $380 at the close, hitting record intraday and closing highs. Its market value reached $955 billion, only a step away from the trillion-dollar market value mark, potentially becoming the ninth listed company globally to break through a market value of $1 trillion. As of the close, the market value had risen nearly $200 billion in a single day, almost equivalent to two Intels.

Taiwan Semiconductor's U.S. shares rose 12%, AMD rose 11.2%, Marvell Technology, Applied Materials, and Broadcom all rose more than 7%, Micron Technology rose 4.6%, Qualcomm, which had fallen more than 1% during the session, rose nearly 1%, while Intel fell more than 7% during the session, down 5.5%, leading the decline among Dow components.

AI concept stocks failed to rise collectively. C3.ai (AI) rose about 10% at the beginning of the session, closing up 2.1%, rising to the highest level since April 3 for two consecutive days. SoundHound.ai (SOUN), which had risen 12% at the start of the session, and BigBear.ai (BBAI), which had risen over 11% at the start of the session, both closed flat. Palantir (PLTR) rose over 8% at the start of the session, closing up 5%. Adobe (ADBE) rose 7.2%. Monolithic Power Systems (MPWR), which is expected to provide power management solutions for Nvidia's AI chip H100, rose 17.5%.

Among the individual stocks reporting earnings, cloud computing company Snowflake (SNOW), which beat first-quarter expectations but lowered full-year guidance due to lackluster second-quarter guidance, fell 16.5%. American Eagle Outfitters (AEO), which is expecting a decline in second-quarter revenue, fell 12%. Dollar Tree (DLTR), a discount retailer with first-quarter EPS earnings below expectations and a 4.7% decrease in gross profit, also fell 12%. Ralph Lauren (RL), a luxury apparel retailer that saw unexpected growth in fourth-quarter revenue and claimed a 30% surge in sales in China, rose 5.3%. Best Buy (BBY), which reported first-quarter revenue below expectations but EPS earnings above expectations, rose 3.1%.

In terms of European stocks, the pan-European stock index fell for three consecutive days, but the decline was significantly mitigated compared to Wednesday due to a rebound in tech stocks. The STOXX 600 fell 0.32%, a far cry from the largest daily drop since March 15 set by a 1.8% drop on Wednesday, still hitting a new closing low since March 30. Major European national stock indices fell for the third consecutive day on Thursday, with declines generally less than at least 1% on Wednesday. UK stocks led the decline, falling over 0.7%.

Among the sectors of the STOXX 600, only five rose on Thursday. Technology rose more than 1.7%, and industrial, travel, banking, and personal and household goods sectors rose less than 0.4%. Of the sectors that fell, oil and gas led the decline, falling more than 2.2%. The STOXX Europe Luxury 10 index, which fell for several consecutive days and plummeted 4.3% on Tuesday, hitting a five-month largest decline, rose nearly 0.9%, moving away from a seven-week low. European chip stocks rose against the market influenced by Nvidia. ASM International (ASMI) rose 8.6%, lithography giant ASML rose 5%, BE Semiconductor (BESI) rose 7.6%.