Following the surge of Nvidia, a representative of AI hardware, Adobe, the leading creative software company, has also experienced a significant increase driven by AI Generated Content (AIGC). As AI software companies gradually demonstrate their performance in the second half of this year, this sector might be on the verge of a breakthrough.

On Thursday, design software provider Adobe reported its second-quarter results for fiscal year 2023, ending June 2. The report revealed that Adobe's revenue for the quarter reached $4.82 billion, a 10% increase year over year, exceeding analyst expectations of $4.77 billion. Earnings Per Share (EPS) under Generally Accepted Accounting Principles (GAAP) was $2.82, also beating the analysts' target range of $2.65 to $2.70.

In terms of individual business divisions, Adobe's Digital Media sector revenue was $3.51 billion, a year-on-year increase of 10%, higher than analyst expectations. Digital Experience division revenue was $1.22 billion, up 12% year on year, meeting analyst expectations.

What's particularly exciting for the market is that Adobe has raised its full-year revenue and profit guidance, stating that the boost from AI to its business will be further reflected in its Q3 and Q4 earnings. Furthermore, management reiterated in the conference call that Adobe's technological innovation can "lead the new era of AIGC."

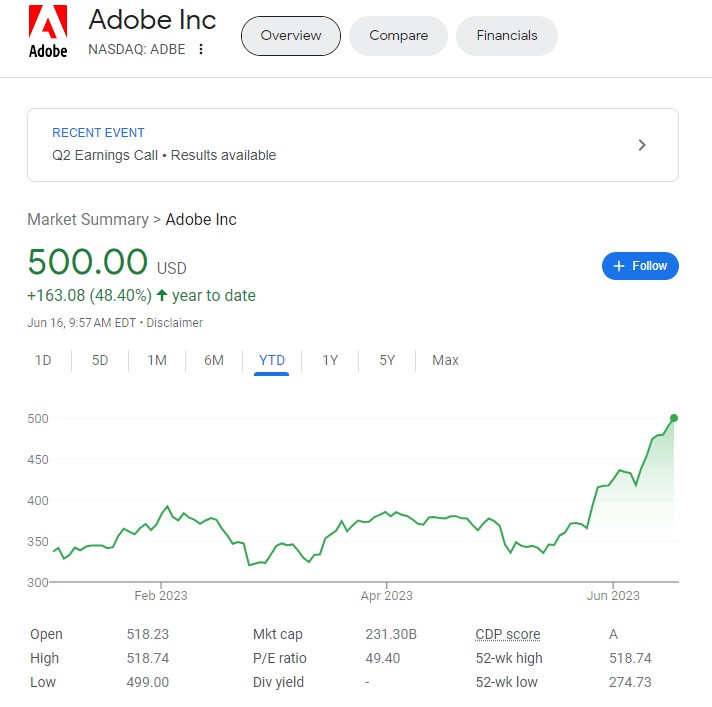

Following the earnings release, Adobe's stock rose over 2% and increased by more than 3.5% in after-hours trading. So far this year, the company's stock has risen nearly 46%, standing out among AI concept stocks.

Faced with the impact of AI, Adobe, a software company serving professional designers, responded swiftly. As Wall Street News previously reported, in March, Adobe launched a differentiated AI creative aid tool, "Firefly," which emphasizes assisting rather than "replacing" creators and focuses on the protection of creators' rights. Hence, it hasn't faced resistance from professional creators like other AIGC tools.

Since its launch, Firefly has been updated multiple times, and Adobe started offering a paid version for business users in early June. In addition, Adobe recently added new AIGC features to its renowned photo editing app, Photoshop.

During the conference call, Adobe executives emphasized that AIGC will be a driving force for the company's revenue and profit growth for many years to come. Adobe's CEO, Shantanu Narayen, stated that Adobe's breakthrough innovations, underpinned by its rich datasets, foundational models, and comprehensive product portfolio, can lead the new era of AIGC.

Part of Adobe's stock price increase also comes from its acquisition of Figma, a rising star in the design industry and one of Adobe's major competitors. Last September, Adobe invested $20 billion to acquire Figma, marking the largest acquisition in the company's history. However, due to regulatory factors, the deal has not yet been completed. Adobe's management stated during the conference call that they continue to engage with U.S., UK, and EU regulators, and the acquisition might be completed by the end of the year.

From the recent trends in the U.S. stock market, the logic behind Adobe's stock price growth is similar to that of Nvidia. Nvidia represents the AI hardware side, and its growth has been proven by performance. Adobe, on the other hand, represents the software side of AI, with its performance verification node coming slightly later than Nvidia's, which sells hardware directly. This may only become apparent with the release of Q3 earnings in August.

However, Adobe's business layout and frequent moves in the AI field have led the market to believe that the increase in performance brought about by AIGC is not just empty talk. Recent research from Shenwan Hongyuan Securities pointed out that companies both domestically and internationally, such as Duolingo, Notion, Kingsoft Office, and iFlytek, have started to increase the subscription prices of their services after launching AI products.

In a previous evaluation of Microsoft, Evercore ISI analyst Kirk Materne suggested that by 2027, AI could bring $100 billion in revenue growth for Microsoft. Materne wrote in the report that despite today's "hype" leading reality, they believe that the impact of artificial intelligence will eventually span every industry and region. Microsoft's unique position in transitioning to an AI platform in the coming years could realize profits.

Extrapolating from this, it's not hard to foresee the performance growth potential brought about by price increases for AI value-added services. In the short term, software companies that can quickly monetize AI innovations have greater financial certainty. Companies like Adobe that can successfully leverage AI to solve real-world problems in work and life could become market darlings in the new wave of hype following the explosion of AI software.