Fueled by the AI boom, the shares of a small Japanese chip design company, Socionext, have skyrocketed over 200% since its listing last October. Particularly since mid-May of this year, the stock's surge has been especially swift, doubling its value in just over a month.

Since its initial public offering (IPO), Socionext has seen a peak increase of up to 260%, touching a high market capitalization of about JPY 957 billion and earning the title of the best-performing stock in the TOPIX index.

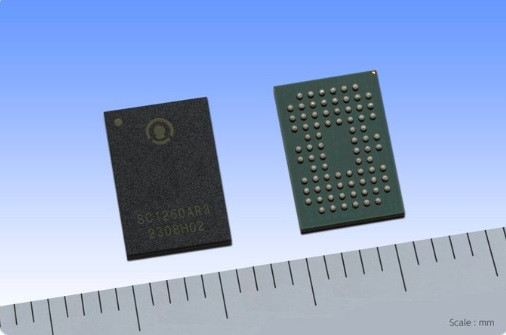

This Yokohama-based company, formed in 2015 from the merger of Fujitsu Semiconductor Ltd.'s and Panasonic Corporation's System on a Chip (SoC) departments, develops customized chips for customers in the consumer, automotive, and industrial sectors.

According to Rina Oshimo, a strategist at Okasan Securities, Socionext differs fundamentally from industry leaders such as Nvidia and AMD. Socionext is the only publicly-traded Japanese company that manufactures custom SoC, and its business model is unique as it only develops and produces chips according to customer requirements after receiving orders.

As per the official website, Socionext develops SoC products used for electric vehicles, smart devices, and data centers.

The CC Japan Income & CC Growth Trust, which holds shares in the company, sees significant growth potential in the SoC design space, especially concerning self-driving cars, mobile communications, 5G, and potential 6G technologies. Richard Aston, the fund's portfolio manager, views the company as a long-term investment. He also noted the company's emphasis on paying dividends and increasing them over time.

In recent days, the company's rapid ascent has somewhat slowed. One primary reason for this is SMBC Nikko's initial downgrade of the company's rating last Wednesday, saying that Socionext's rapid rise appears somewhat excessive. The stock plunged 18% on Thursday, its biggest drop in history.

Of the eight analysts currently covering Socionext, seven have given a "Buy" rating, and one has given a "Hold" rating.

Tim Morse, an analyst at Asymmetry Advisors, stated that the company has broad profit prospects and occupies a unique position in the industry. However, he wouldn't be surprised if investors began to lock in further profits on the industry and the stock, considering its rapid rise.

Looking at the broader perspective, the Japanese stock market, which surged in the first half of the year, is gradually under pressure and has been a significant factor in halting Socionext's share price progression.

Melbourne-based Talaria Capital suggested that the impressive rise in the Japanese stock market since the beginning of the year could cool down in the second half, influenced by expectations of further global economic slowdown.

Hugh Selby-Smith, Joint Chief Investment Officer at the fund management company, believes that the Japanese stock market's price at the end of 2023 might be lower than current levels. He cites as reasons the significant monetary policy tightening by most central banks in developed markets leading to a sluggish global economy, subsequently damaging Japanese exporters. The benchmark Japan TOPIX index touched its highest level since July 1990 earlier this month, having risen 20% so far this year.

Talaria's global equity fund, worth AUD 1.5 billion (approximately USD 1 billion), invested 17% in Japanese stocks at the start of the year, resulting in an 8.4% increase in the fund so far this year. Despite this, Selby-Smith is still optimistic about the Japanese stock market in the next three to five years.