Japan has begun enforcing export controls on 23 categories of semiconductor equipment essential to advanced semiconductor manufacturing, starting July 23rd. According to Asahi Shimbun, a major daily newspaper in Japan, this move is intended to prevent China from producing advanced semiconductors, and is also seen as a response to tightening U.S. restrictions on China. Experts, who spoke to Global Times, see Japan's controls as a classic case of 'harming others without benefiting oneself'.

The 23 types of semiconductor materials and equipment that Japan is restricting exports of include key materials such as hydrogen fluoride, etching fluid, polyimide, and high-purity nitrogen, which are used in various stages of semiconductor manufacturing. Asahi Shimbun reported that while 42 countries and regions including the U.S., South Korea, and Taiwan could simplify procedures through a bundle permit when exporting these devices from Japan, mainland China would need a separate permit from the Minister of Economy, Trade and Industry. This implies the addition of more procedures, potentially more time-consuming, and in some cases, exports might be impossible.

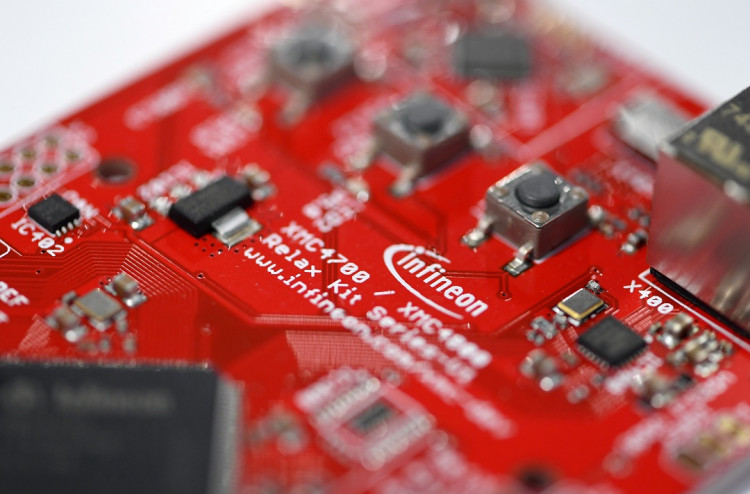

Although companies affected by the semiconductor manufacturing equipment export restrictions have not been publicly disclosed, officials from the Ministry of Economy, Trade and Industry have indicated that the list includes big Japanese businesses like Tokyo Electron, Nikon, and Hitachi.

Last October, the U.S. restricted the export of semiconductor manufacturing equipment to China and subsequently requested Japan and the Netherlands to cooperate. Kyodo News reported that Japan's control over semiconductor manufacturing equipment is indicative of Japan keeping pace with the U.S.

Japan's export restrictions on advanced semiconductor manufacturing equipment were announced as early as May 23rd. Some Japanese public opinion believes these restrictions exceed normal bounds and are detrimental to the development of the semiconductor industry. Asahi Shimbun opined that after the U.S. restricted the export of semiconductor manufacturing equipment to China last October, some Chinese factories were affected, which in turn reduced the production of advanced product manufacturing equipment of Japanese companies. "While it's intended to prevent the use of semiconductor technology for military purposes, it also affects the manufacturing of mass products such as artificial intelligence products and mobile phones," the newspaper stated.

Da Zhigang, director and researcher of the Northeast Asia Research Institute of the Heilongjiang Provincial Academy of Social Sciences and chief expert of the Northeast Asia Strategy Research Institute, told the Global Times that Japan's controls would cause some inconvenience for China, but Japan itself would also face losses. With China being the world's largest semiconductor consumer market, this control will impact Japanese businesses' investments, dampening their entrepreneurial enthusiasm.

Asahi Shimbun noted that China is the largest export country for Japan's semiconductor manufacturing equipment industry. In 2022, three-tenths of Japan's global semiconductor equipment exports were destined for China, and its semiconductor equipment export volume to China far exceeded that to the U.S. The report also mentioned that China is expected to develop its domestic semiconductor industry in response.

Japanese media reported that China is very wary of these restrictions. In December of last year, China filed a lawsuit with the World Trade Organization (WTO) on the grounds that the U.S. restrictions were unjust. This July, China announced that it will start limiting the export of two key raw materials for the semiconductor manufacturing industry from August.