South Korea, the "canary in the coal mine" of the global economy, has seen its exports drop for ten straight months due to the further deterioration in chip demand.

Preliminary data released by the South Korean Ministry of Trade on Tuesday showed that exports in July stood at $50.33 billion, a year-on-year decrease of 16.5%. This represents the tenth consecutive monthly decline and the largest drop in three years, significantly surpassing the 6% drop in June and exceeding the market expectation of 14.5%.

However, for the second consecutive month, South Korea managed to achieve a trade surplus, totaling $1.63 billion, as the nation ended a streak of 15 months of trade deficits in June. The surplus occurred due to a significant decrease in imports, which fell by 25.4% year-on-year to $48.71 billion in July.

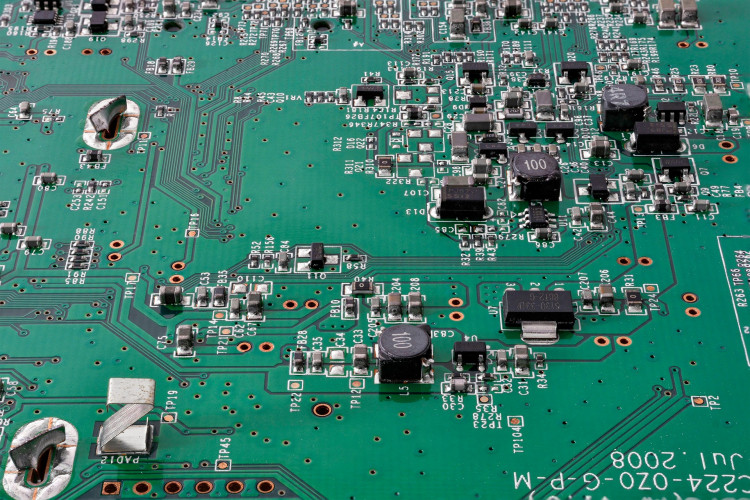

Within these numbers, the chip demand suffered greatly, with semiconductor exports decreasing by 34% year-on-year, a steeper drop than the 28% decline in June. In addition, exports of petroleum products fell by 42%, while petrochemical and steel product exports dropped by 25% and 10% respectively.

Cho Chuel, an analyst at the Korea Institute for Industrial Economics and Trade, opined that semiconductors are crucial to exports and it's unlikely that there will be a revival in exports until there's a recovery in demand and a rebound in prices.

Despite some optimistic news recently that certain chip manufacturers predict a resurgence in demand following a prolonged downturn, the effect of trade on South Korea's economic growth has been profound. The economy grew 0.6% quarter-on-quarter in the last quarter, primarily due to the continued trade deficit.

It's worth noting that South Korea's exports act as a vital barometer for global trade, as the country produces critical supply chain items such as chips, displays, and finished petroleum.

Currently, global economic activity continues to be constrained by high inflation, rising interest rates, and restrictions. South Korea's weaker-than-expected data for July signals a slow recovery in global demand and trade.

In the context of central banks worldwide battling persistent inflation, global demand might continue to be weak. Positioning in the swap market suggests that traders believe the tightening cycles of the U.S. Federal Reserve and the European Central Bank are nearing their end, but the time frame for rates to begin falling may still be a while off.