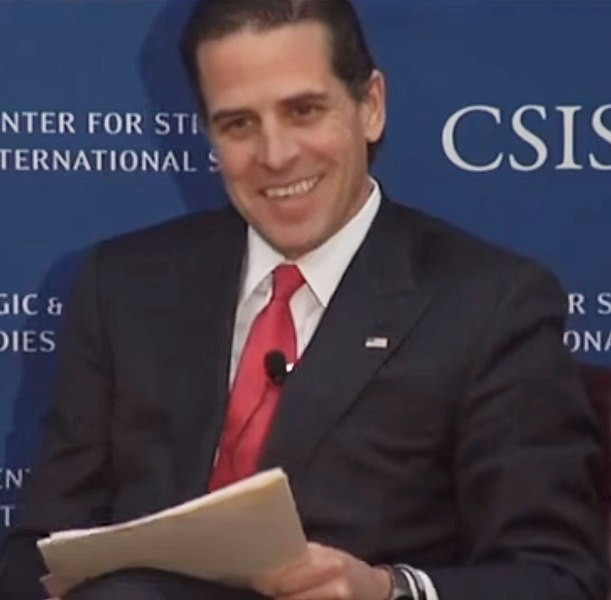

In a recent development, Hunter Biden, the embattled first son, has initiated legal proceedings against two Internal Revenue Service (IRS) whistleblowers. The lawsuit alleges that these agents violated his right to privacy and sought to publicly "embarrass" him by disclosing his tax information.

The legal action, targeting IRS supervisory special agent Greg Shapley and another agent, Joe Ziegler, comes on the heels of Biden's indictment on federal firearms charges. This case, which accuses Biden of misrepresenting his drug use to purchase a firearm in 2018, could potentially coincide with President Joe Biden's 2024 reelection campaign.

The core objective of the lawsuit is to enforce compliance with federal tax and privacy laws. It aims to halt the dissemination of "unsubstantiated allegations" and the "unlawful disclosure" of Hunter's tax details. Abbe Lowell, representing Hunter Biden, stated that the IRS agents have made multiple public statements to the media, revealing confidential tax-related information about a private citizen, thereby aiming to tarnish Mr. Biden's reputation.

The agents, in their defense, had previously informed the House Oversight Committee that political appointees had obstructed the investigation into the first son. They alleged that these appointees shielded investigators from delving into financial aspects linked to President Biden. Furthermore, they claimed that federal prosecutors hindered investigations into potential multi-million dollar payments from a Chinese energy conglomerate to Hunter. These payments, they suggest, might have connections to President Biden.

Ziegler, in a CBS News interview, expressed the challenges they faced. He mentioned that any attempt to question the president's involvement required numerous approvals, making the process cumbersome.

The lawsuit, filed in a Washington, DC federal court, emphasizes that the sharing of Biden's personal tax information is not sanctioned under federal whistleblower protections.

Earlier this year, Hunter Biden had reached a plea agreement with federal authorities. This would have allowed him to plead guilty to two misdemeanors related to tax evasion in 2017 and 2018. However, this agreement fell apart when additional charges related to his overseas business ventures came to light.

Both Shapley and Ziegler have refuted claims of political motivations behind their actions. They argue that their disclosures were in line with federal whistleblower protections. In a recent statement, Shapley's legal team mentioned, "This suit against the IRS is just another frivolous smear by Biden family attorneys trying to divert attention from Hunter Biden's legal challenges."

The unfolding legal drama around Hunter Biden is set against a politically charged backdrop. GOP lawmakers have been contemplating impeachment proceedings against President Joe Biden, alleging his involvement in Hunter's overseas business activities during his tenure as vice president. President Biden has consistently denied any wrongdoing or involvement in these matters.