The U.S. stock market is buzzing with IPO activity, and following in the footsteps of Arm, Instacart is making its sprint to Nasdaq.

This week, Instacart's parent company, Maplebear, will begin trading on the U.S. stock market. The company has set its IPO price at $30 per share, valuing the company at $9.9 billion, aiming to raise up to $660 million.

As a pioneer in the U.S. instant delivery sector, Instacart's delivery business has seen consistent growth, capturing 75% of the market share. However, intensifying competition within the industry threatens its dominant position. Meanwhile, its advertising segment has emerged as a new growth engine, turning last year's losses into profits.

Instacart's IPO has garnered significant market attention for several reasons. On one hand, its journey to going public has been tumultuous. Once the second-largest unicorn in the U.S. with a valuation of $39 billion, its worth has since plummeted to just $9.9 billion, a staggering drop of nearly $29 billion (approximately 210 billion yuan).

On the other hand, Instacart represents a majority of venture-backed startups and serves as a litmus test for the currently stagnant IPO market.

A Bumpy Path to Public Trading

Founded in 2012, Instacart offers consumers fresh produce and daily necessities delivery services, akin to the U.S. version of China's "Meituan."

The outbreak of the pandemic and subsequent stay-at-home orders boosted the online delivery industry, propelling Instacart's performance. In 2020, Instacart saw a 500% increase in total orders, with revenues reaching $1.7 billion.

Riding this growth wave, Instacart began preparations for its IPO. However, the journey was fraught with challenges.

As the pandemic situation improved and the Federal Reserve's interest rate hikes led to a sell-off in tech stocks, Instacart's valuation took a hit. In March 2022, the company voluntarily reduced its valuation from $39 billion to $24 billion. By July, it was further reduced to $15 billion. By the second half of 2022, the valuation continued to decline, and the IPO was temporarily shelved.

In April of this year, reports indicated another valuation drop to $12 billion. In less than two years, Instacart's valuation has shrunk multiple times, with its current IPO valuation at a mere $9.9 billion, a decline of over 70%.

Instant Delivery Growth Amid Fierce Competition

Instacart's primary business is instant delivery. Its core model involves shoppers purchasing items on behalf of users from physical stores and delivering them, a model characterized by its asset-light nature.

Currently, Instacart covers over 1,400 grocery stores in the U.S., accounting for 85% of the U.S. grocery retail market share.

The pandemic-driven market expansion significantly boosted Instacart's performance. Prospectus data shows that from 2018 to 2022, Instacart's Gross Transaction Value (GTV) had a Compound Annual Growth Rate (CAGR) of 80%, compared to the market's CAGR of 50%.

By the end of 2022, Instacart's GTV reached $29 billion, capturing 75% of North America's online grocery sales, making it the largest instant delivery platform in the U.S.

However, as the pandemic's effects waned and industry competition intensified, Instacart's growth slowed down. In the first half of the year, its GTV was $14.937 billion, almost flat compared to the $14.356 billion during the same period the previous year.

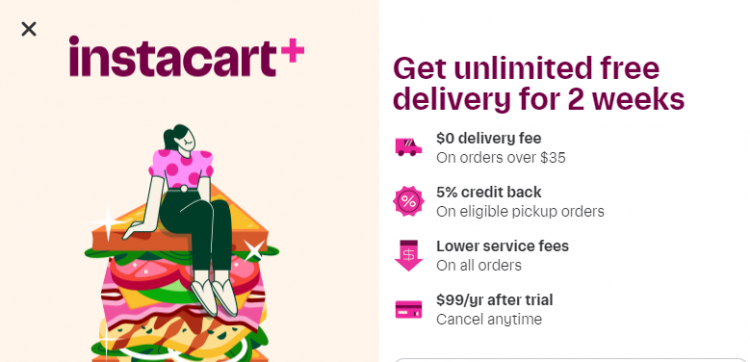

To break the deadlock, Instacart revamped its business model, upgrading its subscription service to Instacart+, which offers benefits like free delivery, cashback, and reduced service fees.

By mid-year, Instacart+ boasted over 5.1 million members (excluding free trial members), a number higher than the previous year's 4.6 million.

Advertising: A Key Profit Driver

Advertising has become an increasingly significant segment for Instacart, emerging as a new growth engine.

In its prospectus, the term "advertising" was mentioned 249 times, more than terms like "delivery" or "pickup," highlighting its importance.

In 2019, Instacart first introduced paid search, and since then, it has continuously strengthened its advertising business. Compared to traditional ad service providers, Instacart's advantage lies in integrating advertising with instant delivery. Specifically, after stimulating consumer demand through ads, products can be delivered to customers within hours.

With the introduction of these products, the number of advertisers on Instacart has been steadily increasing. The prospectus reveals that over 5,500 brands currently use Instacart Ads, a fivefold increase from 2019.

Advertising has been crucial for Instacart to maintain and enhance its profitability.

In 2020, advertising revenue was only $295 million, but by 2021, it nearly doubled to $572 million. In 2022, Instacart's ad revenue further grew to $740 million, accounting for 29% of its total revenue.

The prospectus shows that from 2020 to 2022, Instacart's total revenues were $1.477 billion, $1.834 billion, and $2.551 billion, respectively. Net profits were -$70 million, -$73 million, and $428 million, marking a profitable turn in 2022.

However, it's worth noting that in uncertain economic times, advertisers often cut back on marketing expenditures, which could impact Instacart's overall performance growth.

Overall, Instacart envisions itself beyond just an instant delivery company. In its prospectus, the company expressed its ambition to create a truly omnichannel experience, offering grocery e-commerce features, in-store technology, advertising solutions, and various other services.

A Litmus Test for the Frozen IPO Market

Instacart's IPO is set to be one of the largest this year.

The company has set its IPO price at $30 per share, at the top end of its expected range, further indicating a revival in the U.S. IPO market. Following the successful listing of UK chip design company Arm last week, a successful Instacart trading debut could pave the way for more startups to go public.

The market hopes that Instacart's IPO could trigger a wave of public offerings, thawing a long-frozen market.

Instacart investors suggest that after the company's successful listing, tech startups like Databricks and Socure might also go public. However, it's foreseeable that these companies' valuations will be far below the valuations paid by venture capitalists during the industry's boom years of 2020-2022.