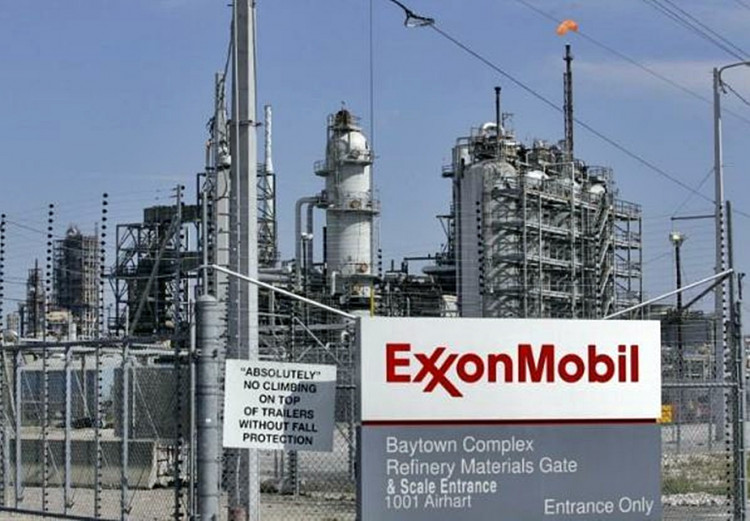

In what's being hailed as the largest acquisition in the oil and gas industry in two decades, oil giant ExxonMobil announced its official plans on Wednesday. The company stated its intention to acquire another oil producer, Pioneer Natural Resources, for a total of $59.5 billion, or $253 per share.

Considering Pioneer's closing price of approximately $55.4 billion on Tuesday, ExxonMobil's offer represents a premium of nearly 7%.

This deal marks the most significant corporate acquisition so far this year and stands as the largest in the oil and gas sector since Exxon's $81 billion acquisition of Mobil in 1999.

Both companies anticipate the transaction to be finalized in the first half of 2024.

Upon completion, the merged entity is expected to control reserves equivalent to 16 billion barrels of crude oil in the Permian Basin, making it the region's top holder. The daily production is projected to reach 4.5 million barrels of oil equivalent.

Neal Dingmann, an analyst at Truist Securities, noted that ExxonMobil's acquisition underscores the Texas-based company's intent, much like its competitors, to bolster its high-quality oil well inventory in the Permian Basin, with Pioneer's inventory position being among the best.

Pioneer's stock rose 1.8% in pre-market trading, while ExxonMobil's shares fell 2.54%.

Aiming for the Permian Goldmine

The primary motivation behind ExxonMobil's acquisition of Pioneer is the Permian Basin, the leading shale oil production region in the U.S. and the Western Hemisphere's most prolific oilfield.

Unlike the division of offshore oilfields among oil giants, shale oil production in the Permian region is more fragmented, primarily managed by independent producers, with Pioneer being one of the largest.

Initially skeptical about shale oil yields, major oil companies were hesitant to venture into the Permian Basin. However, they soon realized the low-cost, low-complexity nature of shale oil extraction, which can begin production within months. This contrasts starkly with multi-billion-dollar offshore mega-projects that require a decade of planning.

The shale gas revolution subsequently positioned the U.S. as the world's top oil producer. Pioneer, having been deeply involved in the Permian since the 1990s, emerged as one of the fastest-growing oil producers post this revolution.

Around 2017, ExxonMobil acquired drilling rights in the Permian for $6 billion from the Bass family of Fort Worth. Since then, oil giants began taking the Permian region seriously, with Chevron, Shell, and British Petroleum (BP) also joining the fray.

Despite this, over 1,000 producers still operate in the basin, with major producers accounting for only about 15% of the total output. This has kept ExxonMobil on the lookout for new acquisition targets.

The subsequent COVID-19 pandemic initially hit oil prices and producers hard. However, the Russo-Ukrainian conflict later stimulated a rise in oil prices, making oil companies some of the most profitable entities last year and providing ExxonMobil with the "ammunition" for the Pioneer acquisition.

Financial reports released at the end of January showed that ExxonMobil's net profit for the previous year reached a record $55.7 billion, approximately 2.4 times its 2021 earnings, averaging a staggering $6.3 million per hour.

Last year's annual profit was 23% higher than ExxonMobil's previous record set in 2008, setting a new all-time high for Western oil giants. ExxonMobil's cash flow for the year also reached a historic high of $62.1 billion, an increase of nearly $23 billion or almost 60% from the previous year.

While this acquisition may face rigorous antitrust scrutiny, antitrust experts interviewed by the media suggest that ExxonMobil and Pioneer could argue that even as the largest producers in the Permian, they represent only a small fraction of the vast global oil and gas market.

The Dawn of Big Oil Mergers?

Boosted by last year's soaring oil prices and subsequent profits, a potential "reshaping" of the U.S. oil and gas industry might be underway.

Wall Street Journal previously reported that the era dominated by small, growth-seeking oil producers in the U.S. might be shifting towards one led by big oil corporations.

To some extent, this "new era" might resemble the period of mega-mergers among oil giants that began in the late 1990s. During that time, companies like ExxonMobil, Chevron, Texaco, and British Petroleum (BP) underwent significant mergers.

Beyond ExxonMobil, Chevron has acquired two smaller oil producers in the past three years and expressed interest in Occidental Petroleum, one of the largest producers in the Permian Basin, earlier this year, although that interest has waned in recent months.

During the shale gas revolution, mid-sized oil producers drove technological and production advancements. However, many went bankrupt during the oil price collapse of 2014-2015. Other medium-sized producers struggled to attract institutional funds due to their size, making them increasingly attractive acquisition targets.

Mark Viviano, managing partner at investment firm Kimmeridge Energy Management, stated, "There are too many companies here... Consolidation is the final piece of the puzzle in rationalizing the shale industry."

Dan Pickering, Chief Investment Officer at financial services firm Pickering Energy Partners, believes the current market conditions are ripe for transactions. Oil prices have rebounded from lows earlier this year, high enough to entice sellers but not so high as to deter potential buyers.

Pickering suggests that if a deal between Exxon and Pioneer materializes, it could invigorate transactions in the Permian Basin. It would indicate that even one of the largest U.S. producers needs to accumulate inventory, and the most productive resources in the U.S.'s richest basin are dwindling. He remarked, "When one company makes a significant move, it forces everyone to seriously consider where they should place their pieces, and if they don't act quickly, will they miss out on something?"