The maritime shipping industry faces a significant upheaval as the majority of container shipping companies have ceased operations in the volatile Red Sea region. The Shanghai Shipping Exchange's latest weekly report vividly illustrates the escalating situation, with a 14.8% surge in the comprehensive index to 1254.99 points, primarily attributed to the armed threats in the area. This development has led to a stark rise in freight rates for Asia-Europe and other routes, with the rates for routes from Shanghai Port to Europe, the Mediterranean, and the Persian Gulf witnessing a substantial increase.

The magnitude of the rate hikes is unusual. Market freight rates from Shanghai Port to key European and Mediterranean ports have reached unprecedented levels, reflecting the urgency and scarcity created by the regional instability. The Ningbo Shipping Exchange reported that an astounding 85% of container shipping companies have suspended their cargo carriage on the Red Sea routes due to the escalating number of merchant ship attacks. This drastic reduction in operational vessels has led to a spike in market booking freight rates, with the Red Sea route index soaring by 161.9% compared to the previous week.

In response to the persistent dangers, several shipping giants, including Maersk and CMA CGM, have rerouted their vessels via the Cape of Good Hope until mid-February. This adjustment implies a significant extension in transportation time and an increase in associated costs. Despite these precautions, some vessels remain in the high-risk area, with companies like Wilson Ship Management Company employing armed guards and sophisticated software tools to enhance safety measures.

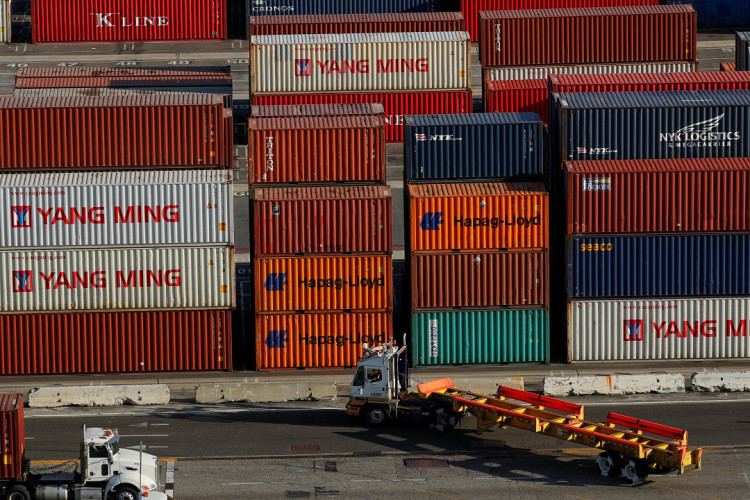

The rerouting decision has far-reaching implications, including increased transportation distances, amplified market costs, and a strain on Asia-Europe route capacity. Shipping companies have announced a slew of surcharges to cope with the additional expenses incurred by the detour. These surcharges, such as the Transportation Disruption Surcharge and Red Sea Surcharge, will inevitably reflect in the spot freight rates, further exacerbating the cost of shipping.

The ripple effects of the Red Sea's instability are palpable across the global supply chain. Customers, apprehensive about future freight rate hikes, are rescheduling orders, while companies like IKEA anticipate delays in product deliveries. The oil transport sector is also feeling the heat, with significant players like British Petroleum and Equinor avoiding the region, potentially leading to a surge in market crude oil prices.

As the shipping industry grapples with this crisis, the escalating situation in the Red Sea serves as a stark reminder of the fragility and interconnectedness of global trade routes. With the shipping sector's stock prices responding to these tumultuous developments, the situation remains fluid, and the industry braces for a period of prolonged uncertainty and adjustment.