As the United Kingdom navigates a tumultuous economic landscape, the nation faces a confluence of challenges, including persistent high inflation, stagnant wage growth, and a significant shortfall in infrastructure investment. While the economy has managed to evade the depths of a severe recession, signs of robust growth remain elusive, casting a shadow over prospects ahead of the autumn 2024 elections.

Surveys of UK residents paint a bleak picture of the economic climate, with the high cost of living persistently burdening households despite some wage increases. The majority of respondents hold a grim outlook for 2024, anticipating economic growth to either stagnate or barely inch above 0.5%. This sentiment underscores the pervasive sense of uncertainty that grips the nation.

Central to the UK's economic woes is an acute shortage in infrastructure investment, particularly in the energy sector. Economists and experts like Diane Coyle, Professor of Public Policy at Cambridge University, highlight the need for increased public investment to jumpstart long-term growth. However, such initiatives seem unlikely to materialize before a new government takes office. The UK's abundant wind energy resources, capable of generating cheap electricity, remain underutilized, with grid construction efficiency hampered by protective measures for ancient buildings and local opposition. The government's restrictive stance on onshore wind farm installations further exacerbates the situation, leading to protracted delays and increased costs for projects essential to the nation's energy transition.

As the UK gears up for elections in autumn 2024, the Labour Party, led by Keir Starmer, promises a radical overhaul of the country's restrictive infrastructure planning system to facilitate a more efficient grid. This pledge reflects a growing recognition of the need for decisive action to address the country's infrastructure deficit.

Inflation continues to be a thorn in the UK's side, with the Consumer Price Index (CPI) recording a 3.9% year-on-year rise in November. While this figure represents a decline from expected levels, prices remain stubbornly high, squeezing households already grappling with increased housing costs due to interest rate hikes. The upcoming renegotiation of mortgages for a substantial number of households adds another layer of financial strain.

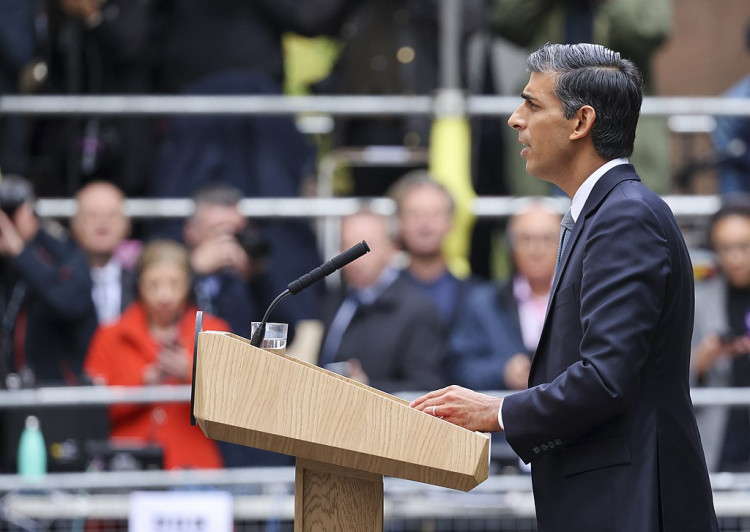

Chancellor of the Exchequer Jeremy Hunt has expressed optimism for 2024, pinning hopes on policies like the recent national insurance tax cut and anticipated tax reductions in March's budget. Yet, an annual survey of economists reveals a consensus that significant improvements in living standards are unlikely before the election, despite a falling inflation rate.

As the UK inches closer to the 2024 elections, the economic landscape is fraught with challenges. Stagnation, inflation, and infrastructural deficiencies loom large, demanding strategic and long-term solutions. The nation's path to recovery and growth is complex and uncertain, with the upcoming elections set to play a pivotal role in shaping the future of the UK's economy.