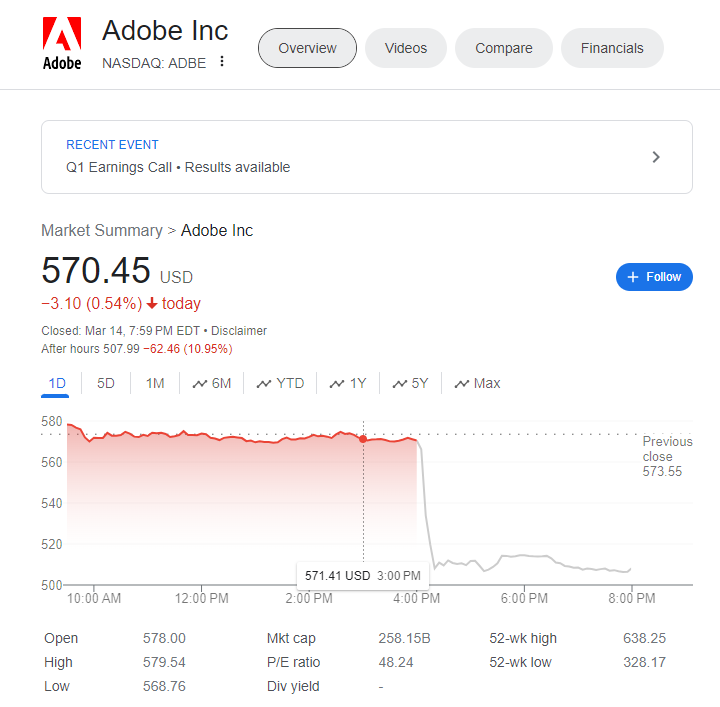

Adobe Inc. witnessed a significant slump in its stock value, dropping by approximately 10% in after-hours trading, despite posting robust fiscal first-quarter results. This downturn was primarily attributed to the company's forecast for the upcoming quarter, which did not meet the market's lofty expectations.

In the recent quarter ending March 1, Adobe reported an adjusted earnings per share of $4.48, surpassing the $4.38 figure anticipated by analysts polled by LSEG. The company's revenue also exceeded forecasts, reaching $5.18 billion against the expected $5.14 billion. However, this 11% year-over-year growth was overshadowed by concerns over future revenue projections.

Adobe's net income saw a downturn to $620 million, or $1.36 per share, a decrease from the $1.25 billion, or $2.71 per share, recorded in the same period last year. This drop was partly due to the termination of Adobe's planned $20 billion acquisition of Figma, which resulted in a $1 billion termination fee.

The company has been at the forefront of integrating artificial intelligence into its offerings, as evidenced by the early release of an AI assistant for its Reader and Acrobat apps. Additionally, Adobe's collaboration with OpenAI on the Sora project, which generates videos from written descriptions, signifies its commitment to advancing AI capabilities within its product suite.

For the fiscal second quarter, Adobe projects earnings between $4.35 and $4.40 per share, with expected revenue ranging from $5.25 billion to $5.30 billion. This guidance indicates a 9% growth at its midpoint, slightly below the analysts' revenue expectation of $5.31 billion.

David Wadhwani, President of Adobe's Digital Media Business, expressed optimism about product enhancements in Adobe Express, Firefly Services AI, and the new Acrobat assistant driving growth in the latter half of the year. He emphasized the potential for acceleration in digital media annualized recurring revenue as a result of these innovations.

In a bold move to boost shareholder value, Adobe announced a substantial $25 billion share buyback program. This decision reflects the company's confidence in its financial health and long-term growth prospects.

Despite the after-hours dip, Adobe shares have experienced a 4% decline year-to-date, contrasting with the S&P 500 index's 8% gain over the same period. This performance underscores the heightened scrutiny and volatility that Adobe faces in the current market environment.

The mixed financial outlook, coupled with Adobe's strategic initiatives in AI and digital media, presents a complex picture for investors. As the company navigates through these challenges, the technology sector and broader market will be closely watching Adobe's ability to adapt and thrive amidst evolving industry dynamics.