More than 8 million New York residents will receive direct "inflation refund" checks later this year, following a tentative agreement between Governor Kathy Hochul and state lawmakers. The payments, which are part of the state's $254 billion fiscal year 2026 budget, are expected to cost $2 billion and will be sent automatically to qualifying taxpayers.

The program aims to offset the ongoing impact of high consumer prices. "This is targeted relief for middle- and working-class New Yorkers who need a little extra help," a spokesperson for the Division of the Budget told Gothamist. The governor's office said the funds will return "sharp increases in the state's collection of sales tax" to residents hit hardest by inflation.

Under the plan, roughly 8.2 million tax filers will qualify. Individual filers with a state adjusted gross income (AGI) of $75,000 or less will receive $200, while those earning between $75,000.01 and $150,000 will receive $150. Joint filers with AGIs up to $150,000 will get $400, and those earning between $150,000.01 and $300,000 will receive $300. Anyone with income above the thresholds or claimed as a dependent is excluded.

"This is money people can use to buy groceries, pay utility bills, or just get through the week," the budget spokesperson said.

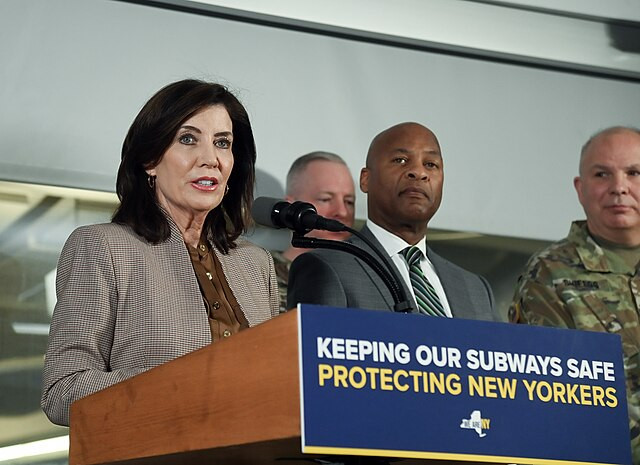

Governor Hochul, in announcing the proposal, stated, "The cost of living is still too damn high, so I promised to put more money in your pockets - and we got it done." She added, "When I said your family is my fight, I mean it - and I'll never stop fighting for you."

The payments will be issued automatically by the New York State Department of Taxation and Finance using 2023 tax data. "There's no need to apply or submit additional forms - if you're eligible, you'll get a check in the mail," the spokesperson said.

Although a specific mailing timeline has not been confirmed, state officials anticipate that the checks will begin going out in the fall. The legislature is expected to begin voting on the final language of the proposal this week.

The inflation refund checks are part of a broader relief package included in the state's budget. Also approved was a plan to provide free school breakfast and lunch to 2.7 million students statewide, saving families an estimated $165 per child in monthly grocery expenses.

Additionally, the budget includes a phased-in middle-class tax cut projected to save 8.3 million New Yorkers nearly $1 billion annually. "Once the rate change is fully phased in," the governor's office stated, "the middle class tax cut will deliver hundreds of dollars in average savings to three out of every four taxpayers in the state. This will bring taxes for the middle class to their lowest level in 70 years."