Ethan Zhao

Senior Reporter

The Latest

-

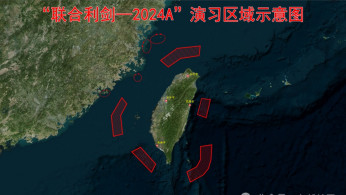

Beijing Starts 'Punishment' Exercises Near Taiwan in Response to 'Separatist Acts'

China commenced two days of intensive military drills around Taiwan on Thursday, just three days after Lai Ching-te assumed office as Taiwan's new president. The exercises, which Beijing described as "punishment" for "separatist acts," underscore the escalating tensions between China and the democratically governed island.

China commenced two days of intensive military drills around Taiwan on Thursday, just three days after Lai Ching-te assumed office as Taiwan's new president. The exercises, which Beijing described as "punishment" for "separatist acts," underscore the escalating tensions between China and the democratically governed island. -

Vietnam Cuts Power to Foxconn, India's AC Sales Soar Amid Severe Southeast Asia Heatwave

Southeast Asia is experiencing another intense heatwave this year, with temperatures soaring to new heights across Vietnam, India, and the Philippines, significantly impacting power demand and sales of cooling appliances.

Southeast Asia is experiencing another intense heatwave this year, with temperatures soaring to new heights across Vietnam, India, and the Philippines, significantly impacting power demand and sales of cooling appliances. -

JD.com Seeks to Raise $1.5 Billion in Convertible Bond Deal Amid Expansion Plans

JD.com, one of China's leading online retailers, is embarking on a significant financial maneuver, aiming to raise $1.5 billion through a convertible bond sale. The move, revealed in the company's regulatory filings on Tuesday, highlights JD.com's strategic efforts to bolster its global operations and enhance its supply chain network.

JD.com, one of China's leading online retailers, is embarking on a significant financial maneuver, aiming to raise $1.5 billion through a convertible bond sale. The move, revealed in the company's regulatory filings on Tuesday, highlights JD.com's strategic efforts to bolster its global operations and enhance its supply chain network. -

China Sanctions Former U.S. Lawmaker Mike Gallagher Over Taiwan Support

Beijing announced on Tuesday that it has imposed sanctions on former U.S. Representative Mike Gallagher. The Chinese government cited Gallagher's actions and statements, which they claim interfered in China's internal affairs, as the reasons for these punitive measures.

Beijing announced on Tuesday that it has imposed sanctions on former U.S. Representative Mike Gallagher. The Chinese government cited Gallagher's actions and statements, which they claim interfered in China's internal affairs, as the reasons for these punitive measures. -

China's Fiscal Revenue Decline Highlights Economic Struggles Amid Property Sector Weakness

China's fiscal landscape showed signs of strain as fiscal revenue declined by 2.7% in the first four months of 2024 compared to the same period last year.

China's fiscal landscape showed signs of strain as fiscal revenue declined by 2.7% in the first four months of 2024 compared to the same period last year. -

China's Property Rescue Measures Fall Short, Leaving Market in Limbo

Despite being hailed as "historic" steps, the efforts appeared insufficient to instill confidence and drive a sustainable recovery in the market. The Hang Seng Mainland Properties Index dipped 0.7%, erasing some of the gains accrued earlier in the month following the Politburo's pledge to coordinate efforts to reduce housing inventory.

Despite being hailed as "historic" steps, the efforts appeared insufficient to instill confidence and drive a sustainable recovery in the market. The Hang Seng Mainland Properties Index dipped 0.7%, erasing some of the gains accrued earlier in the month following the Politburo's pledge to coordinate efforts to reduce housing inventory. -

Taiwan's New President Calls for Peace, Urges Beijing to End Military Threats

Taiwan's new president, Lai Ching-te, has called on China to cease its political and military intimidation against the island and to engage in dialogue rather than confrontation. Sworn in on Monday, Lai emphasized Taiwan's unwavering commitment to democracy and freedom, stating that there can be no concessions on these core values.

Taiwan's new president, Lai Ching-te, has called on China to cease its political and military intimidation against the island and to engage in dialogue rather than confrontation. Sworn in on Monday, Lai emphasized Taiwan's unwavering commitment to democracy and freedom, stating that there can be no concessions on these core values. -

China Unveils 1 Trillion Yuan Rescue Package for Crisis-Hit Property Sector

China has announced a comprehensive rescue package for its crisis-stricken property sector, with the central bank facilitating 1 trillion yuan ($138 billion) in extra funding and easing mortgage rules, while local governments are set to buy "some" unsold apartments.

China has announced a comprehensive rescue package for its crisis-stricken property sector, with the central bank facilitating 1 trillion yuan ($138 billion) in extra funding and easing mortgage rules, while local governments are set to buy "some" unsold apartments. -

Putin and Xi Reaffirm 'No-Limits' Partnership as Russia Launches New Ukraine Offensive

Russian President Vladimir Putin and Chinese leader Xi Jinping pledged to deepen their "no-limits" partnership during a Beijing summit on Thursday, as both countries face growing tensions with the United States and its allies. The largely symbolic visit, which coincided with Russia's new offensive in northeast Ukraine's Kharkiv region, underscored the strengthening ties between Moscow and Beijing in the face of Western pressure.

Russian President Vladimir Putin and Chinese leader Xi Jinping pledged to deepen their "no-limits" partnership during a Beijing summit on Thursday, as both countries face growing tensions with the United States and its allies. The largely symbolic visit, which coincided with Russia's new offensive in northeast Ukraine's Kharkiv region, underscored the strengthening ties between Moscow and Beijing in the face of Western pressure. -

China Accuses U.S. of "Bullying" as Biden Announces $18 Billion in Tariff Hikes

The Biden administration has announced plans to significantly increase tariffs on a range of Chinese imports, a move that has elicited sharp criticism from Beijing and promises of retaliation.

The Biden administration has announced plans to significantly increase tariffs on a range of Chinese imports, a move that has elicited sharp criticism from Beijing and promises of retaliation.