Jerry Lin

The Latest

-

US Treasury Yields Hit Yearly Highs as Rate Cut Expectations Shift to December

As the latest economic indicators roll in, U.S. Treasury yields have reached the highest levels seen this year, signaling a shift in investor expectations regarding the Federal Reserve's monetary policy timeline. The rise in yields, particularly evident in the 10- and 30-year bonds, underscores growing concerns about persistent inflation despite signs of slowing economic growth.

As the latest economic indicators roll in, U.S. Treasury yields have reached the highest levels seen this year, signaling a shift in investor expectations regarding the Federal Reserve's monetary policy timeline. The rise in yields, particularly evident in the 10- and 30-year bonds, underscores growing concerns about persistent inflation despite signs of slowing economic growth. -

U.S. GDP Grows at 1.6% in First Quarter, Falling Short of Analysts’ Forecasts

According to the Bureau of Economic Analysis's advance estimate, the gross domestic product (GDP) increased at an annualized rate of 1.6%, a sharp deceleration from the 3.4% growth recorded in the previous quarter and below the Bloomberg-surveyed economists' projection of 2.5%.

According to the Bureau of Economic Analysis's advance estimate, the gross domestic product (GDP) increased at an annualized rate of 1.6%, a sharp deceleration from the 3.4% growth recorded in the previous quarter and below the Bloomberg-surveyed economists' projection of 2.5%. -

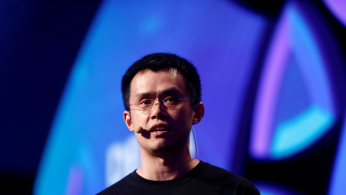

U.S. Prosecutors Seek 36-Month Prison Sentence for Ex-Binance CEO Changpeng Zhao Over Money Laundering Charges

U.S. prosecutors are pushing for a 36-month prison sentence for Changpeng Zhao, the founder and former chief executive of Binance, the world's largest cryptocurrency exchange, following his guilty plea to violating laws against money laundering.

U.S. prosecutors are pushing for a 36-month prison sentence for Changpeng Zhao, the founder and former chief executive of Binance, the world's largest cryptocurrency exchange, following his guilty plea to violating laws against money laundering. -

U.S. New Home Sales Surge in March Despite Elevated Mortgage Rates, Outpacing Expectations

According to government figures released Tuesday, new home sales, which account for about 14% of the U.S. home sales market, jumped 8.8% last month to a seasonally adjusted annual rate of 693,000, the highest level since September.

According to government figures released Tuesday, new home sales, which account for about 14% of the U.S. home sales market, jumped 8.8% last month to a seasonally adjusted annual rate of 693,000, the highest level since September. -

Gold Sees Temporary Dip but Long-Term Outlook Remains Bullish, Experts Say

Gold prices extended losses for a second day on Tuesday, hitting a more than two-week low as fears of escalating tensions in the Middle East subsided, prompting investors to book profits ahead of key U.S. economic data this week. Spot gold fell 0.3% to $2,318.90 per ounce, while U.S. gold futures slipped 0.6% to $2,331.80.

Gold prices extended losses for a second day on Tuesday, hitting a more than two-week low as fears of escalating tensions in the Middle East subsided, prompting investors to book profits ahead of key U.S. economic data this week. Spot gold fell 0.3% to $2,318.90 per ounce, while U.S. gold futures slipped 0.6% to $2,331.80. -

Gold Prices Plummet in Largest Drop in Nearly Two Years Amid Easing Middle East Tensions

Gold experienced a dramatic plunge on Monday, marking the steepest intraday decline in nearly two years, as easing tensions in the Middle East diminished the demand for safe-haven assets. Spot gold dropped by 2.8% to a low of $2,324.96 per ounce at one point during the day, falling nearly $70 from the previous Friday's closing high-a significant retreat not seen since June 2022.

Gold experienced a dramatic plunge on Monday, marking the steepest intraday decline in nearly two years, as easing tensions in the Middle East diminished the demand for safe-haven assets. Spot gold dropped by 2.8% to a low of $2,324.96 per ounce at one point during the day, falling nearly $70 from the previous Friday's closing high-a significant retreat not seen since June 2022. -

Gold and Silver Face Profit-Taking Pressure Amid Perceived Easing of Middle East Tensions

Gold prices experienced a sharp decline on Monday, as geopolitical tensions in the Middle East appeared to ease and traders shifted their focus to upcoming U.S. economic data that could provide insights into the Federal Reserve's monetary policy outlook. The precious metal fell more than 2% to trade near $2,345 an ounce, ending a five-week rally, the longest such streak in over a year.

Gold prices experienced a sharp decline on Monday, as geopolitical tensions in the Middle East appeared to ease and traders shifted their focus to upcoming U.S. economic data that could provide insights into the Federal Reserve's monetary policy outlook. The precious metal fell more than 2% to trade near $2,345 an ounce, ending a five-week rally, the longest such streak in over a year. -

Bitcoin Halving: Experts Weigh in on Potential Price Impact as Supply Cut Looms

As Bitcoin's fourth halving approaches, estimated to occur around 9 p.m. ET today, industry experts are divided on the potential impact the event could have on the cryptocurrency's price.

As Bitcoin's fourth halving approaches, estimated to occur around 9 p.m. ET today, industry experts are divided on the potential impact the event could have on the cryptocurrency's price. -

Middle East Tensions Spark Brief Oil Price Surge, Gold Nears Record High Amid Uncertainty

Oil prices experienced a rollercoaster ride on Friday, initially spiking by more than $3 after reports of Israeli attacks on Iranian soil, but later slipping as Tehran played down the incident, signaling that an escalation of hostilities in the Middle East might be avoided.

Oil prices experienced a rollercoaster ride on Friday, initially spiking by more than $3 after reports of Israeli attacks on Iranian soil, but later slipping as Tehran played down the incident, signaling that an escalation of hostilities in the Middle East might be avoided. -

Bitcoin Briefly Drops Below $60,000 as Crypto Market Cools Off Ahead of Halving Event

Bitcoin (BTC) has given up its recent gains, plunging below the $60,000 level during the morning hours of the U.S. trading session on Wednesday. The world's largest cryptocurrency briefly fell as low as $59,888, marking its weakest price since early March and a decline of more than 18% from its all-time high of $73,797 reached on March 14.

Bitcoin (BTC) has given up its recent gains, plunging below the $60,000 level during the morning hours of the U.S. trading session on Wednesday. The world's largest cryptocurrency briefly fell as low as $59,888, marking its weakest price since early March and a decline of more than 18% from its all-time high of $73,797 reached on March 14.