Jonathan Wong

The Latest

-

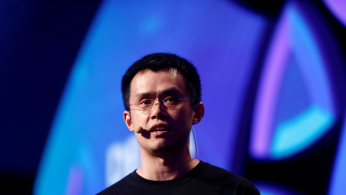

FTX Sues Binance and Former CEO Zhao for $1.8 Billion, Alleging Fraud and Market Manipulation

The embattled estate of collapsed cryptocurrency exchange FTX has launched a $1.8 billion lawsuit against Binance and its former CEO, Changpeng Zhao (CZ), in a legal move that underscores the escalating tensions in the crypto sector following FTX's catastrophic downfall. Filed in Delaware, the complaint alleges that Binance and Zhao were involved in a "fraudulent" 2021 share deal that destabilized FTX, ultimately leading to its collapse.

The embattled estate of collapsed cryptocurrency exchange FTX has launched a $1.8 billion lawsuit against Binance and its former CEO, Changpeng Zhao (CZ), in a legal move that underscores the escalating tensions in the crypto sector following FTX's catastrophic downfall. Filed in Delaware, the complaint alleges that Binance and Zhao were involved in a "fraudulent" 2021 share deal that destabilized FTX, ultimately leading to its collapse. -

Elon Musk’s Net Worth Surges to $300B as Tesla Hits $1 Trillion Market Cap

Tesla's stock reached a milestone Friday, with the electric vehicle manufacturer's market value soaring past $1 trillion, spurred by a 10% surge in share price. Investors appear optimistic that a second Trump administration, with Elon Musk as a close ally, will create a favorable regulatory landscape for Tesla and its ambitious autonomous driving goals. The rally comes on the heels of Donald Trump's recent election victory, which, according to market analysts, may bring regulatory relief for Tesla and other tech giants.

Tesla's stock reached a milestone Friday, with the electric vehicle manufacturer's market value soaring past $1 trillion, spurred by a 10% surge in share price. Investors appear optimistic that a second Trump administration, with Elon Musk as a close ally, will create a favorable regulatory landscape for Tesla and its ambitious autonomous driving goals. The rally comes on the heels of Donald Trump's recent election victory, which, according to market analysts, may bring regulatory relief for Tesla and other tech giants. -

Qantas Flight Makes Emergency Landing After Engine Failure, Sydney Airport Faces Runway Fire

A Qantas Airways flight bound for Brisbane made an emergency landing at Sydney Airport on Friday following an engine failure shortly after takeoff, the Australian airline confirmed. Flight QF520, a Boeing 737-800, took off from Sydney at 12:35 p.m. local time but quickly encountered a mechanical issue that forced it to circle before landing safely back at the airport. The incident coincided with a grass fire near a parallel runway, adding to the unfolding drama.

A Qantas Airways flight bound for Brisbane made an emergency landing at Sydney Airport on Friday following an engine failure shortly after takeoff, the Australian airline confirmed. Flight QF520, a Boeing 737-800, took off from Sydney at 12:35 p.m. local time but quickly encountered a mechanical issue that forced it to circle before landing safely back at the airport. The incident coincided with a grass fire near a parallel runway, adding to the unfolding drama. -

Trump Media Shares Plummet After Election Surge

Donald Trump's recent election victory has had a significant impact on the stock market, with shares of Trump Media & Technology Group (DJT), the parent company of his social media platform Truth Social, experiencing extreme volatility.

Donald Trump's recent election victory has had a significant impact on the stock market, with shares of Trump Media & Technology Group (DJT), the parent company of his social media platform Truth Social, experiencing extreme volatility. -

Climate Tech Stocks Tumble as Trump’s Win Sparks Fears of Regulatory Rollbacks

In the aftermath of Donald Trump's election victory, shares of climate technology and renewable energy companies took a significant hit as markets braced for potential policy reversals and regulatory rollbacks under his incoming administration. Trump's campaign promises to dismantle existing clean energy projects and shift focus back to fossil fuels sent shockwaves through the industry, leading to a sell-off in key sectors.

In the aftermath of Donald Trump's election victory, shares of climate technology and renewable energy companies took a significant hit as markets braced for potential policy reversals and regulatory rollbacks under his incoming administration. Trump's campaign promises to dismantle existing clean energy projects and shift focus back to fossil fuels sent shockwaves through the industry, leading to a sell-off in key sectors. -

Moderna Delivers Surprise Q3 Profit as Cost-Cutting and Strong COVID Vaccine Sales Drive Growth

Moderna surprised Wall Street with a third-quarter profit on Thursday, driven by robust COVID-19 vaccine sales and significant cost-cutting measures. The Cambridge, Massachusetts-based biotech company posted net income of $13 million, or 3 cents per share, a sharp turnaround from a net loss of $3.63 billion, or $9.53 per share, during the same period last year. Analysts had anticipated a loss of $1.90 per share. Shares of Moderna surged nearly 9% in premarket trading on the unexpected earnings report.

Moderna surprised Wall Street with a third-quarter profit on Thursday, driven by robust COVID-19 vaccine sales and significant cost-cutting measures. The Cambridge, Massachusetts-based biotech company posted net income of $13 million, or 3 cents per share, a sharp turnaround from a net loss of $3.63 billion, or $9.53 per share, during the same period last year. Analysts had anticipated a loss of $1.90 per share. Shares of Moderna surged nearly 9% in premarket trading on the unexpected earnings report. -

Warner Bros. Discovery Posts Surprise Profit as Max Subscriber Growth Surges on Olympic Boost

Warner Bros. Discovery delivered a surprise profit for the third quarter, driven by strong growth in its Max streaming platform, buoyed by exclusive rights to stream the Paris Olympics. This milestone performance came despite challenges in its traditional TV business and a downturn in studio revenues. Shares of the company rose 3.7% in premarket trading on the back of the unexpected financial results.

Warner Bros. Discovery delivered a surprise profit for the third quarter, driven by strong growth in its Max streaming platform, buoyed by exclusive rights to stream the Paris Olympics. This milestone performance came despite challenges in its traditional TV business and a downturn in studio revenues. Shares of the company rose 3.7% in premarket trading on the back of the unexpected financial results. -

Tesla Shares Surge 14% as Trump Win Fuels Optimism for U.S. EV Market

Shares of Tesla Inc. soared by more than 14% Wednesday as investors reacted positively to the return of Donald Trump to the White House. The expectation of a policy shift favoring the electric vehicle (EV) giant and its CEO Elon Musk drove market enthusiasm, with analysts forecasting a favorable environment for Tesla's dominance in the sector.

Shares of Tesla Inc. soared by more than 14% Wednesday as investors reacted positively to the return of Donald Trump to the White House. The expectation of a policy shift favoring the electric vehicle (EV) giant and its CEO Elon Musk drove market enthusiasm, with analysts forecasting a favorable environment for Tesla's dominance in the sector. -

Trump Media Stock Surges Over 30% as Donald Trump Wins Presidential Election

Shares of Trump Media & Technology Group jump following Trump’s victory over Kamala Harris, reflecting market enthusiasm for his return.

Shares of Trump Media & Technology Group jump following Trump’s victory over Kamala Harris, reflecting market enthusiasm for his return. -

Saudi Aramco Faces $31 Billion Dividend Dilemma as Oil Prices Drop and Debt Climbs

Saudi Aramco, the world's largest oil producer, is facing a tough financial decision in early 2024: whether to continue funding its massive $31 billion quarterly dividend or risk exacerbating Saudi Arabia's budget shortfall. Amid falling oil prices and increased production cuts from OPEC+, the oil giant has seen profits dip and debt levels rise, putting strain on its balance sheet.

Saudi Aramco, the world's largest oil producer, is facing a tough financial decision in early 2024: whether to continue funding its massive $31 billion quarterly dividend or risk exacerbating Saudi Arabia's budget shortfall. Amid falling oil prices and increased production cuts from OPEC+, the oil giant has seen profits dip and debt levels rise, putting strain on its balance sheet.