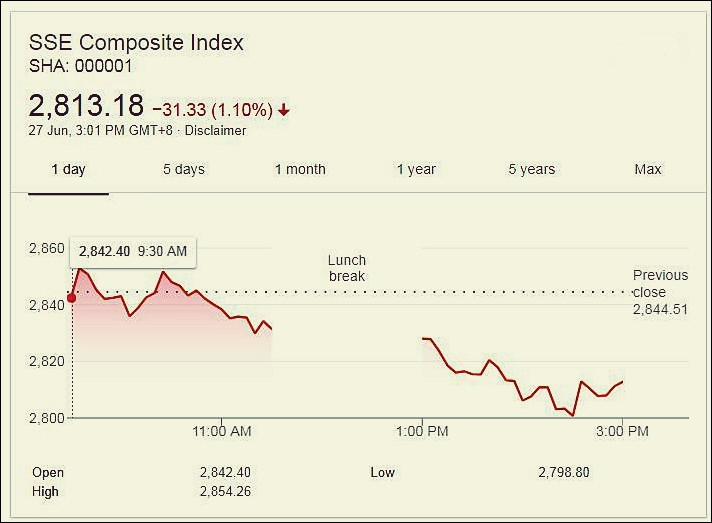

China's Shanghai Composite, also known as the SSE Composite Index, officially entered bear market territory on June 27 after being battered by bad news about an all but inevitable trade war with the United States and a sagging economy.

It skidded 0.5 percent on Tuesday, closing at 2,844.66. This amounted to a total drop of 20.1 percent from the composite's January peak, and down 14 percent year-on-year. About a third of the stocks on the Shanghai and Shenzhen exchanges were technically oversold on Tuesday.

Chinese stocks have lost $1.6 trillion in total value since a high in January, an amount larger than the size of Canada's entire economy. Analysts said Chinese investors haven't seen a market rout like this since 2015 when a market crash eliminated $5 trillion in market value. Despite this, China's growth and earnings remain solid, said American global investment firm BlackRock, Inc.

A bear market is generally accepted as one experiencing a price decline of 20 percent or more over a two-month period. An analysis of U.S. stock market data from 1926 to 2014 found that a typical bear market "lasted 1.3 years with an average cumulative loss of -41 percent ." Annualized declines for bear markets range from -19.7 percent to -47 percent.

The Shanghai Composite is a stock market index of all stocks (A and B shares) traded at the Shanghai Stock Exchange, the world's third-largest stock market by market capitalization.

The economic difficulties savaging China's economy prompted the People's Bank of China (the de facto central bank) to cut the reserve requirement ratio for large commercial banks this week. Analysts said the PBOC move is an attempt to calm market fears being stoked by China's weak economic data and China-U.S. trade tensions.

Economic data for May confirms China's economy still remains in a precarious state, heavily burdened by debt and at the mercy of credit, especially unregulated shadow banking.

"We have been waiting to see a notable slowdown in the Chinese economy, and it is finally here," wrote Wei Yao, Chief China Economist-Societe Generale, in a note to bank clients.

"The impact of the deleveraging policy is very clear. The final window for the PBoC (People's Bank of China, the central bank) to adjust its OMO (Open Market Operations) rates -- for whatever reason -- is probably closed, and a gradual shift towards more accommodative liquidity conditions should take place. Further RRR (required rate of return) cuts will be inevitable, in our view."

She based her gloomy assessment of China's economy on a range of distressing economic indicators. Retail sales growth is the slowest in over 15 years, while infrastructure investment plunged to 2.3 percent from 11.3 percent. Fixed asset investment growth again plummeted, this time to an all-time low of 3.9 percent from 6.1 percent in April. Export growth fell to 3.2 percent in May from 3.7 percent in April.

Worsening relations with the U.S. have unnerved investors in Chinese companies since China's immense manufacturing sector is heavily reliant on trade and American imports.