China's exports surged 7.2% in July compared to a year earlier, outpacing economists' expectations and providing a short-term boost as Beijing races to ship goods ahead of the expiration of a fragile tariff truce with the United States. Imports also rose 4.1%, their strongest gain in 12 months, customs data showed Thursday.

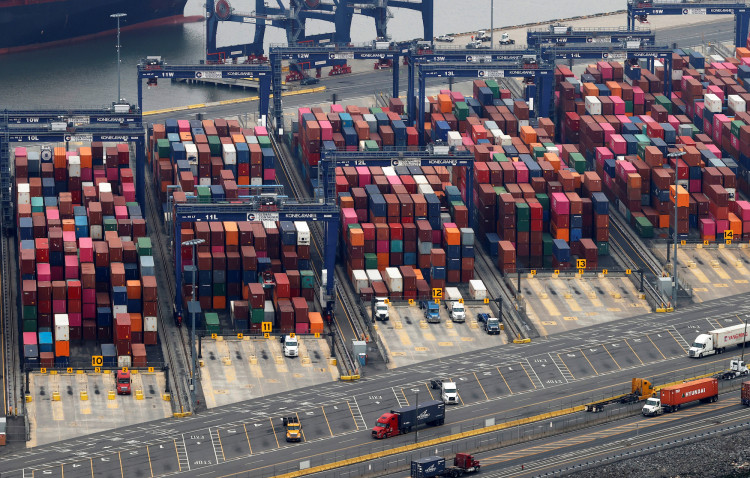

The July trade figures reflect front-loading by manufacturers trying to beat the August 12 deadline, when U.S. President Donald Trump's temporary suspension of import tariffs is set to expire. China's overall trade surplus for the year reached $683.5 billion through July, up 32% from the same period in 2024.

Despite the headline growth, China's exports to the U.S. dropped 21.7% year-over-year in July, continuing a four-month decline. Imports from the U.S. also contracted by 18.9%. Meanwhile, Chinese shipments to Southeast Asia surged 16.6%, while exports to the European Union grew 9.2%.

"The trade data suggests that the Southeast Asian markets play an ever more important role in U.S.-China trade," said Xu Tianchen, senior economist at the Economist Intelligence Unit. "Trump's transshipment tariffs are aimed at China, since it was already an issue during Trump 1.0."

Trump has ramped up tariff threats in recent weeks, including a new 40% levy on goods routed through transit hubs, which took effect Thursday. He has also proposed a 100% tariff on pharmaceutical and chip imports and a 25% penalty on goods from countries, including China, that continue purchasing Russian oil.

In response, Beijing has eased restrictions on rare earths exports and restarted U.S. semiconductor software shipments. Semiconductor exports from China rose 16% in July to 31.8 billion units, while auto exports jumped 26% to 694,000 units. Rare earth shipments climbed 21.4% year-over-year.

Imports also painted a mixed picture. Soybean imports hit 11.66 million tonnes, an 18.4% increase, as Chinese buyers ramped up purchases from Brazil. Crude oil imports rose 11.5%, while iron ore shipments declined, signaling ongoing weakness in China's construction sector.

"While import growth surprised on the upside in July, this may reflect inventory building for certain commodities," said Zichun Huang, China economist at Capital Economics. "There was less improvement in imports of other products, and shipments of iron ore continued to cool."

Factory activity remained subdued, with China's official manufacturing PMI slipping to 49.3 in July, a three-month low, falling short of the expected 49.7. Economists warned that the strong export momentum may not persist.

Trump has signaled openness to meeting Chinese President Xi Jinping later this year if progress is made on trade. However, the risk of escalating tariffs remains high. U.S.-bound Chinese goods are already subject to a 10% baseline tariff, an additional 25% duty from Trump's first term, and a 20% fentanyl-related tariff.