Facebook made financial history in the worst possible way, losing close to $119 billion of its value in the largest one-day loss in U.S. market history.

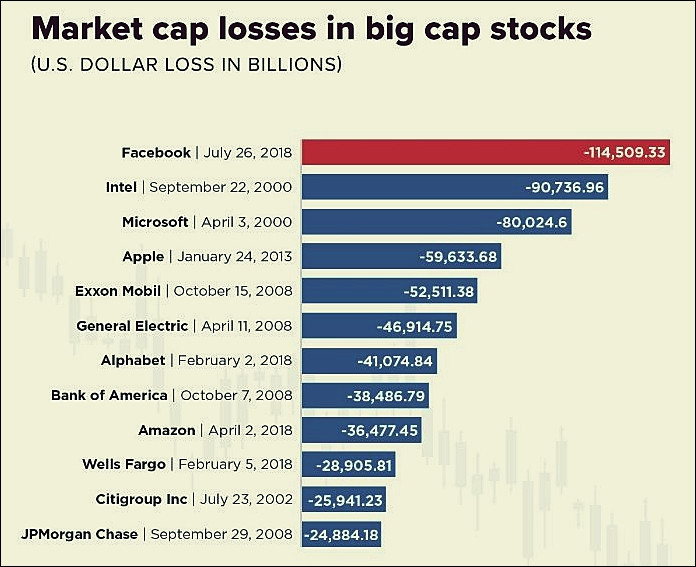

To put it in perspective, this massive loss is more than the value of Starbucks, UPS and Goldman Sachs combined, said one market analyst. Facebook's plunge also greatly exceeds Intel's $91 billion single-day loss in September 2000.

Facebook shares plummeted by $41.24, or almost 19 percent, to $176.26 a day after the company reported less than sterling operating results.

"We're investing so much in security it will significantly impact our profitability," said founder and CEO Mark Zuckerberg to explain the disappointing operating results. He also said Facebook is combating the intractable fake news plague and privacy violation issues like the Cambridge Analytica scandal.

Facebook's stock plunged after the company's second-quarter earnings report revealed lackluster results. Facebook admitted revenue and subscriber growth missed Wall Street's expectations and warned of slowing growth ahead. Facebook's market cap was down by as much as $148 billion before recovering later in the day.

Droves of investors began unloading their shares after Facebook's forecast showed the number of its active users will more slowly than expected. Facebook is also dealing with Europe's new privacy laws. The report was Facebook's first full quarter since the Cambridge Analytica scandal.

CFO David Wehner that European advertising revenue growth in Europe "decelerated more quickly than other regions," partially because of the new European privacy laws. This revelation shocked investors who were led to believe the new General Data Protection Regulation (GDPR) laws wouldn't hurt revenue. GDPR was only in effect for one month of the quarter, which means the company may feel more of an impact in the current quarter.

"The implementation of GDPR gave a large number of Facebook users control over their privacy, and it should have been patently obvious to investors (and to us) that allowing users control would result in slightly lower engagement," said Wehner, alluding to GDPR. Wehner believes GDPR may end up favoring Facebook and other large companies over the long-term.

"The perceived narrative surrounding Facebook has changed after yesterday's earnings announcement," said Jeff Henriksen, managing partner at Thorpe Abbotts Capital. "The market seems to be questioning the quality of growth seen in the past."

Zuckerberg's wealth also took a hit on Wednesday. Zuckerberg saw his fortune drop by $15.9 billion to some $71 billion. His personal loss alone exceeds the value of companies such as Molson Coors and Macy's, which have market values of $14 billion and $12 billion, respectively.