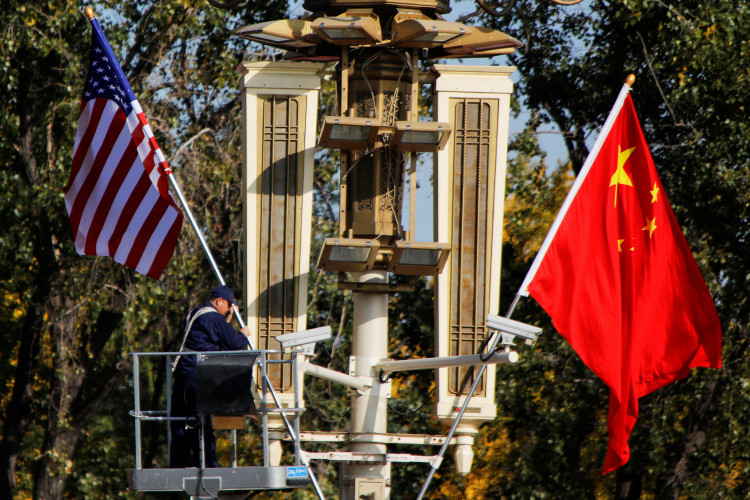

China and the United States are currently locked in a bitter trade war that has seen more than $50 billion in tariffs being levied on various goods produced by the two superpowers. Recently, as part of its retaliatory actions, China announced that the country will halt accepting license applications from U.S. companies dealing in the financial services and other industries. China added that it will uplift the new regulation when Washington makes amends in order to settle the ongoing trade war.

This latest development confirms some of the fear many U.S. companies have had since the trade war began a couple of months ago. When U.S. President Donald Trump announced massive tariffs against various Chinese goods in order to curb the growth of China's booming economy, many U.S. companies with operations based in China have shown concern.

Many observers noted that these concerns and fears have the substantial basis. By provoking China into a bitter trade war, the U.S. indirectly closes one of the world's biggest market for American products and services. Some U.S. companies also fear that China might limit their access into the county's massive consumer market, something that is beginning to shape into reality with Washington's barrage trade assault.

U.S.-China Business Council Vice-President for China Operations Jacob Parker said that the new license policy applies to most industries that China have promised to open to interested foreign investors and competitors. Included in the portfolio of the group are about 200 American companies that have operations in China.

Mr. Parker said that meetings between USCBC representatives and some Cabinet-level Chinese officials took place over the past three weeks. Mr. Parker added that it was on one of these meetings that the Chinese officials confirm that the country will not receive new applications until measures to curb the tension brought by the trade war are imposed.

Nevertheless, Chinese officials have confirmed that the country will open foreign access to various areas of business. These areas will include asset management, banking, insurance, and securities.

U.S. President Trump initially imposed tariffs against Chinese good amounting to $50 billion. As part of its retaliatory measures, Beijing also imposed close the same amount on various American products. As repercussion to a said trade war, China is now running low on American goods.

Market analysts are predicting that China's next set of tariffs might target the logistics and engineering industries should the trade war continue. These two are the industries which the U.S. runs a trade surplus with China.