Optimism spread across investment markets with stocks closing higher on Wednesday ahead of the highly-anticipated China-U.S. trade talks.

According to The Associated Press, retailers, energy firms, and industrial stocks drove the overall stock hike on Wednesday. The rise in shares celebrated four days of a broadly winning streak.

The Nasdaq composite climbed 0.1 percent at 7,420.38 while the S&P index rose 0.3 percent at 2,573.03. The Dow Jones Industrial Average saw an increase of 0.5 percent at 25,543.27. Finally, the Russell 2000 index that's made up of smaller-company shares, advanced by 0.3 percent at 1,542.94.

Chief Market Strategist at Prudential Financial, Quincy Krosby said of the developments, "The president's seemingly positive tone regarding trade has helped underpin the market, particularly the industrial names. That's a positive catalyst for the market."

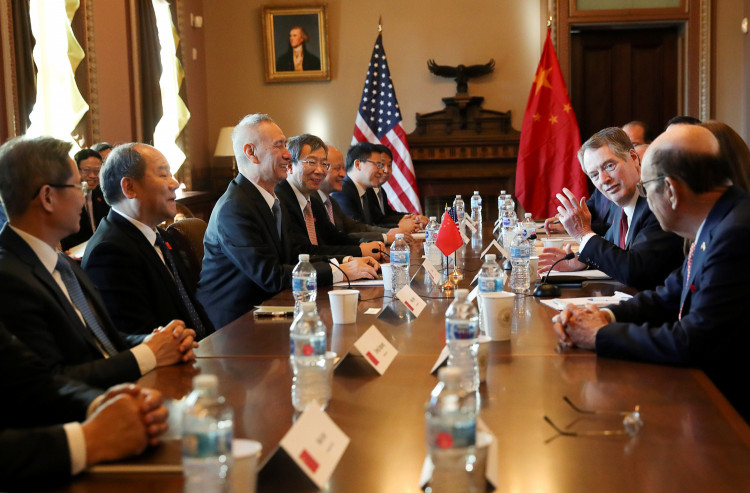

Chinese and U.S. delegations are scheduled to discuss trade issues on Thursday and Friday in hopes of striking a deal before the March 2 deadline on the tariff truce that U.S. President Donald Trump previously set.

Trump ignited optimism among investors when he said there is a good chance he will extend the deadline if both parties come out of the discussions with positive progress. Analysts and financial experts have expressed their faith that the delegations will come closer to a deal after this week's meetings.

Meanwhile, Chinese stocks also regained momentum on Wednesday as investors in China have rallied along with American investors in a bid to keep the stock market optimism through the trade talks.

Market Watch reported that The Shanghai Composite saw a gain of 9.1 percent while the Chinese yuan took a stand against the U.S. dollar following Trump's latest announcement about the potential tariff deadline extension. Furthermore, the Shenzhen index advanced by 9.6 percent.

Experts noted that the dips in stock prices late last year were affected by the China-U.S. trade dispute and changes in American corporate credit standards. With hope for a deal to come around after this week's negotiations, the overall stock market may see greater developments in the long run.

Among the Chinese officials who will engage in this week's sessions is China's top economic adviser, Vice Premier Liu He. As for the American delegation, Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin will join the meetings.

Earlier Wednesday, Trump informed the media that negotiations have been developing "very well" so far, CNBC News reported. While the U.S. president said he will not meet Chinese President Xi Jinping before the March deadline, White House Press Secretary Sarah Sanders reportedly recommended that the two leaders meet at Trump's Florida retreat.