By the first-half of 2020, Facebook will launch a new digital currency (or cryptocurrency) called "Libra" and a new financial system built around its new digital wallet called "Calibra."

The open-source digital currency called Libra won't be run by Facebook, but by the nonprofit Libra Association based in Geneva, Switzerland and supported by a number of companies and organizations. Libra Association will promote the open-sourced Libra blockchain. It will also create a developer platform with its own Move programming language.

The association will sign-up businesses to accept Libra for payment and even give customers discounts or rewards.

Facebook said the goal of Libra is to become broadly accessible, stable and secure digital currency. Libra will be a "stablecoin" pegged to the U.S. dollar.

"If you buy $50 of Libra, your $50 makes its way to the Libra Reserve," said David Marcus, leader of Facebook's Calibra division.

"It's designed to be stable and confer values on Libra that makes it more like a traditional currency than any of the digital currencies are now. This is the way paper money was created."

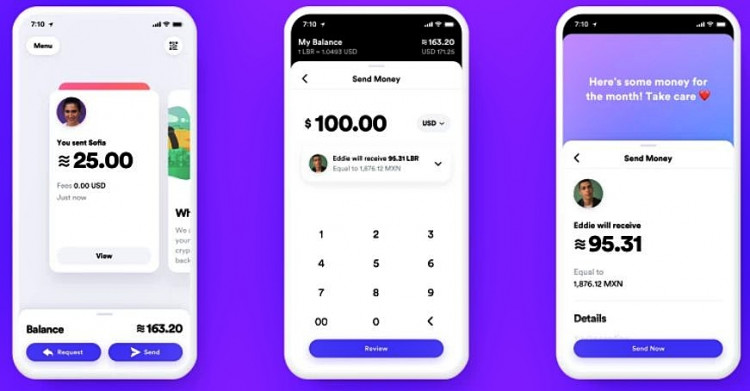

Facebook, however, will run Calibra (also the name for its subsidiary), which is building a digital wallet of the same name for storing and exchanging the currency

The Libra blockchain is open-source, which means anyone can build a service or app using the digital currency. The wallets developed to use the service will be interoperable, so a user will be able to send money from Facebook's Calibra wallet to any other system that accepts Libra.

Facebook leads the consortium that developed Libra. Founding members of this consortium are 27 other companies and organizations.

Their shared goal is to have at least 100 companies and organizations on board for Libra's launch in 2020. Each member will manage one of the "nodes," or locations where transactions involving Libra are validated.

Among the member financial companies are Visa, Stripe, PayPal and Mercado Pago, which will help merchants accept Libra. Tech company members include eBay, Lyft, Uber, Spotify, and Latin American payments platform Mercado Pago.

"We've seen the internet change the game for everything that could be digitized, except for money," said Marcus.

"The numbers really speak for themselves. There are 1.7 billion people around the world that are unbanked, the same number are underserved by financial services.

"Now, anyone with a cheap smartphone has access to all the info they want in the world for free with a basic data plan. Why doesn't money work the same way?"