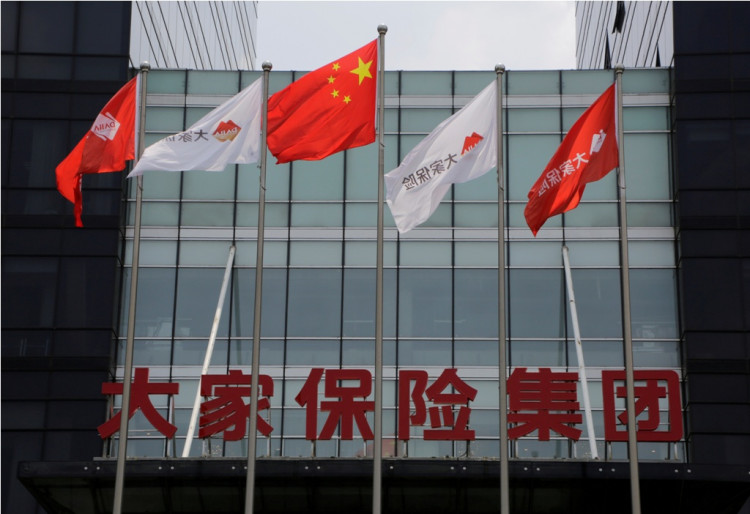

China's state-owned Dajia Insurance Group's logo is now the new face of Anbang Insurance Group's former Beijing office. The news came following the announcement that Dajia is taking over the casualty and property assets of the troubled firm.

According to the South China Morning Post, the Chinese Banking and Insurance Regulatory Commission (CBIRC) confirmed on Thursday that Dajia, the joint venture between Sinopec Group, SAIC Motor, and the China Insurance Fund will block any Anbang plans to set up new insurance businesses.

The latest developments in the Dajia takeover came as expected. In May of last year, former Anbang Chairman Wu Xiaohui was sentenced to 18 years behind bars for guilty charges on embezzlement of over $12 billion and fraud.

Since his arrest, Wu's conglomerate was put under state control. At that time, Beijing said Anbang was a national risk to the country's overall financial market. Aside from being jailed, Wu's assets of around $1.5 billion were confiscated.

Wu appealed a few months after his arrest by the Shanghai People's Court threw the appeal. According to the court, there was sufficient evidence to convict him accurately, adding that his "sentencing was appropriate."

Xinhua reported that the takeover was initially set for a year but it was extended and will be effective until February next year as the restructuring process requires more time and participation from the newly-formed Dajia.

The CBIRC explained that Dajia is being encouraged to participate in the arduous restructuring, especially now that the new structure is expected to abide by Chinese laws.

The units of Anbang that will be taken over by Dajia are namely: Anbang Asset Management Co., Anbang Pension Insurance, Anbang Life Insurance, and Anbang Property & Casualty Insurance. For the latter, the Dajia Property & Casualty Insurance department will be established.

After the restructuring process, Dajia is expected to continue providing various plans for the Chinese public including asset management, pension or social security insurances, and health insurances.

The dismantling of Anbang is part of Beijing's work with regulatory groups that are committed to breaking up financial institutions deemed as high-risk and could be tampering the stability of the Chinese financial market. Irregularities and high-risk loopholes in financial institutions have been the center of crackdowns by the commission over the past few years.

Vice-Chairman of the Commission, Liang Tao, said the next goal is to "accelerate Anbang's asset disposal" as authorities recommended reducing the insurer's wealth management products that are not largely focused on its insurance business.