The recent presidential polls did not turn quite well for Mauricio Macri, who was all anxious to get another shot at the highest post in the land only to succumb to a shock primary election-loss that pushed Argentina deeper into an economic hole.

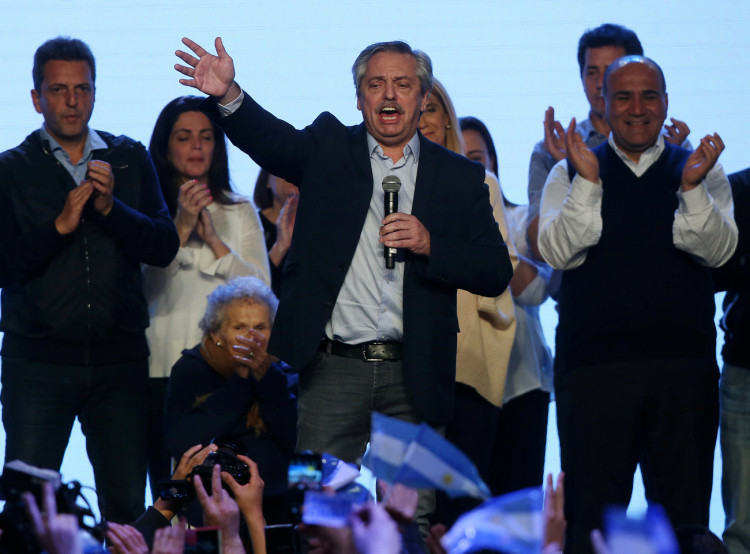

Macri is now faced with a lot of difficult reality, including the relinquishing of power of his trade officials, and a worsening of the country's financial burdens. His fierce rival Alberto Fernandez, on the other hand, has emerged as the strong candidate to win the presidential elections set October 27.

The recent bad publicity against Macri may trigger a new series of economy problems after a short reprieve last week. The country's international bonds are the first ones on the line, while the Argentine peso and trading markets are also seen to bear the brunt of the post primary shockwave.

According to AMMP Capital Investments market head Nadir Naemi, Argentina's current economic woes puts a big doubt over the nation's credibility in terms of credit, and is seen to put more burden on its currency and bonds." "This will put more uncertainty... we are staying out," Naemi pointe out.

Meanwhile, as this developed, Argentina's Minister of Economics Nicolas Dujovne has quit his post in the midst of a financial chaos made worse by the Macri's loss in the primary election. As a result, the Argentine currency lost 21 percent of its market value versus the United States dollar after Macri's huge defeat last Sunday.

Credit rating firms Fitch and Standard & Poor's cut Argentina's debt standing over worries concerns regarding a possible market default after the primary results. Days later, Macri made public a series of actions that included decreases in income tax and hiking subsidies in welfare. With this, Dujovne was quoted as saying that Argentina's financial team needed a revamp.

Hernan Lacunza, who is the incumbent minister of economy of Buenos Aires region, will replace Dujovne. A major cabinet revamp has been planned for the past weeks.

The support given by the International Monetary Fund had been crucial in Macri's efforts to revive the nation's currency. However, Fernandez disclosed that the measure must be analyzed carefully because the country is not hitting its financial goals. Fernandez said that "it is not possible" to pay back the IMF on time. What remains as a viable option, he said, was to re-set payments.

The looming possibility that the South American nation will fall short of repaying its debt as gauged by credit default swaps, grew in the past days. The Merval share index shed 46 percent in the last week throughout Friday, as prices of bonds fell around 31 percent and the peso dropped 19 percent.