As part of China's further opening-up measures, officials from the country's foreign exchange regulation agency have announced plans to entice more overseas participation.

In particular, the regulator specifically mentioned plans to encourage more overseas investors to trade in the country's NASDAQ-styled technology innovation board, or otherwise known as the Star Market.

According to the deputy director of the State Administration of Foreign Exchange (SAFE), Lu Lei, the plan will be to further open up the country's capital markets through measures that will make it more conducive to overseas investors. However, Lu mentioned at a forum held over the weekend that the process will be done in a steady and orderly manner.

The agency plans to slowly ramp up its opening-up efforts in order to minimize risk and to strengthen control. Lu explained that they want to promote a higher-standard opening up that will ensure minimal risk.

The official stated that "prudent macro management" will be the key to the further development of China's markets. Through this method, the basic stability of the foreign markets will be ensured as it will essentially eliminate the risks involved in large-scale and unstable cross-border capital movements.

SAFE will also be focusing on attracting foreign investors to the country's Star Market. The agency plans to implement various measures that will support the further development of the technology innovation board and to encourage foreign participation.

These measures will include the addition of new regulations to the country's foreign exchange markets with the goal of maintaining order and protecting the rights of both the investors and the listed companies.

According to SAFE, China's foreign exchange markets had a turnover of around $21.9 trillion in the first nine months of this year. While the figure is impressive, the agency hopes that its plans would further increase turnover rates in the coming months, particularly through the additional foreign participation.

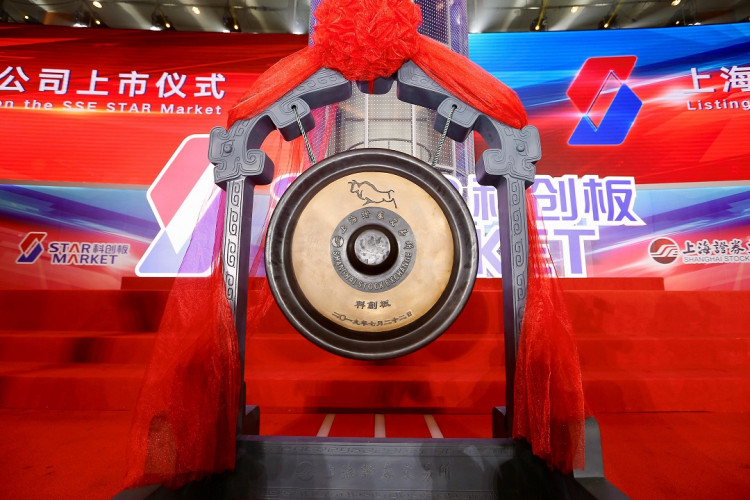

The Star Market was created by the Shanghai Stock Exchange in response to Chinese President Xi Jinping's call to accelerate development in the country's tech industry. The board showcases some of the country's most promising tech companies, essentially becoming China's version of the NASDAQ.

The listing was very well received when it was launched in July, with some companies seeing gains of up to 400 percent above their initial listing prices. The first few days since the listing was made public saw some frenzied trading in the market. This was largely driven by investors with an appetite for risky speculation. The initial chaos prompted the exchange operator to revise regulations to regain control.