S&P 500 and Nasdaq ended Monday in fresh new highs as reports of China-US trade officials signing the phase one trade deal later this week. The biggest stimulus is when the United States removed China out of its list of currency manipulators. The positive movement was also triggered by the easing of tensions between the US and Iran.

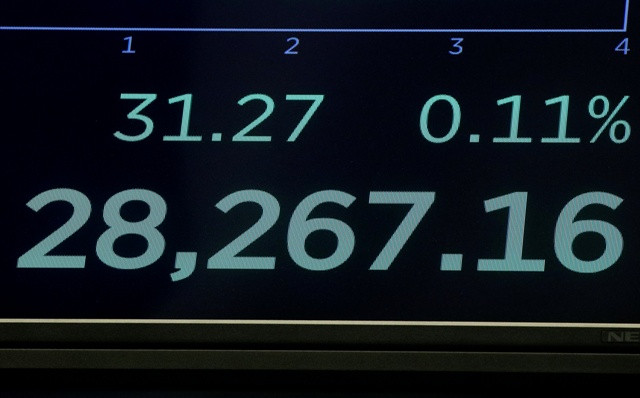

The S&P 500 gained 0.7%, closing at 3,288.13 while Nasdaq advanced 1% to 9,273.93. The Dow Jones Industrial Average climbed 83.28 points or 0.3% to 28,907.05.

The world's two largest economies are pushing through with the signing of the phase one deal on January 15, a development that global markets have been anticipating. US President Donald Trump had mentioned about phase two in the recent weeks leading up to January 15.

Fears of World War 3 have also subsided when both the US and Iran decided to back down from further escalation. Trump called for renewed diplomacy with Tehran and instead pursuing economic sanctions against Iran. Iran, on the other hand, chose to focus on resolving domestic issues in the meantime.

The Dow fell 235 points on January 3 following US airstrikes that killed Iran's top commander, General Qasem Soleimani, in Baghdad. Various US stocks plummeted as well following news of the controversial airstrike.

Aside from Dow, the other indexes also started the trading day lower than the performance they showed during the holidays. The S&P 500 dipped 0.7% lower while the Nasdaq Composite plunged 0.8%. The three indexes bounced back slightly as of press time, but, it remains to be their worst day coming in from their strongest performances in the past month.

Market analysts believed investors now fear the possibility of a major escalation between the US and Iran. Talks of a Wolrd War 3 are growing stronger as the countries' respective allies may come to their aid. Political observers believed it won't be long before Russia (one of Iran's allies) and NATO (one of the American allies) could be pulled into the equation.

Dow's plunge came unfortunately after the US stock market showed remarkable promise during the holiday months. The Dow had, in fact, rose to more than 300 points just the day before the US airstrike in Baghdad.

The markets had only started performing on positive stimuli such as the Federal Reserves interest rate cuts and optimism over the China-US phase one deal to be signed on January 15.

Soleimani was a crucial military figure in Iran and his death could provoke strong retaliatory actions from Tehran. Indeed, the Iranian government said it is no longer bound to a nuclear agreement it made with the US in 2015. With that, the country said it would no longer limit its enrichment of uranium as stated within the 2015 nuclear deal.

The US defended its decision to conduct the airstrike, accusing Soleiman as the brain behind proxy wars that are happening in the Middle East such as conflicts in Iraq, Syria, and Yemen. The Iranian top commander was also allegedly the brain behind conflicts in Lebanon and Hezbollah.

Thankfully, both governments decided to back down and moved forward, although tensions remain rife. The biggest concern now among markets is that the Middle East is the point of contact of oil major oil-producing countries that supply globally. Soleiman's killing could disrupt business and trade, crippling all oil-dependent industries worldwide.

Still, there are those who remained optimistic, dismissive of the possibility of an all-out war between US and Iran. For example, Dryden Pence, chief investment officer at Pence Wealth Management, said that market volatility will be short-lived.