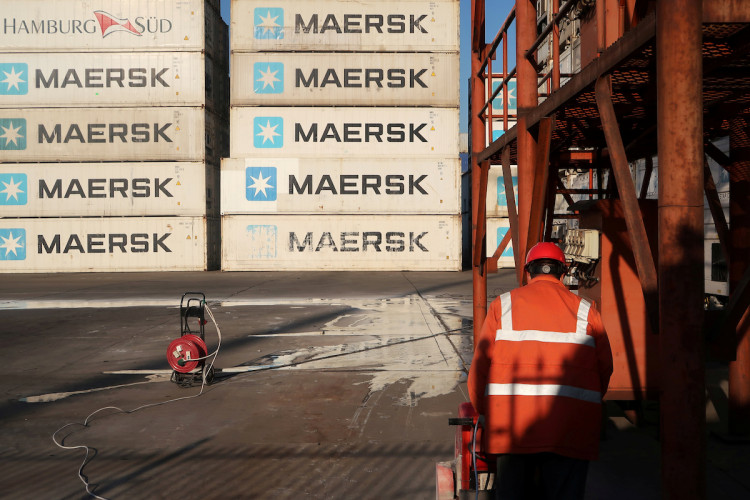

Danish multinational A.P. Møller-Mærsk A/S, the largest container ship and supply vessel operator in the world since 1996, this early is warning the Covid-19 outbreak raging throughout China might have a material impact on its operations for the entire year.

"The outlook for 2020 is impacted by the current outbreak of the coronavirus in China, which has significantly lowered visibility on what to expect in 2020," said Maersk in a statement.

The company forecasts a weak start to the year because factories in China remain closed for longer than usual after the Chinese New Year holiday ended February 8 due to the Covid-19 outbreak.

"Weekly container vessel calls at key Chinese ports were significantly down compared to last year during the last weeks of January and the first weeks of February," noted Maersk.

Maersk, which is considered a barometer for international trade, also reiterated its sober forecast that sees a weaker 1% to 3% growth in global container demand for 2020. Global container demand grew 1.4% in 2019 and 3.8% in 2018. Despite the gloom, Maersk CEO Soren Skou remains optimistic about a rebound in the second quarter.

The Covid-19 outbreak has stunned the global container shipping industry. Shipping firms are reducing calls to Chinese ports and re-routing cargoes, setting the scene for delivery delays for most of the year. These moves will impact earnings and profitability.

Maersk, which handles one in every five containers shipped by sea worldwide, reported a lower-than-expected fourth-quarter profit Thursday. It said fourth quarter EBITDA (earnings before interest, tax, depreciation and amortization) came to $1.46 billion, well below the $1.51 billion forecast by 24 analysts in a consensus poll compiled by Maersk.

The company said it expects 2020 EBITDA of $5.5 billion compared to $6.0 billion expected by analysts and the $5.7 billion achieved in 2019. Maersk also posted an unexpected net loss in the quarter of $72 million from a profit of $46 million year-on-year. A FactSet analyst poll had expected a net profit of $343 million.

Maersk saw revenue plunge 5.6% to $9.67 billion as against expectations of $9.94 billion as its Transport & Logistics Division lowered capacity to adjust to market conditions. It said its financials were materially impacted by implementing the IFRS 16 accounting standard and 2019 figures aren't comparable with last year.

Transport & Logistics, the company's largest operating unit, saw a decline in revenue as volumes dropped 1.8% while freight rates slid 0.4%. Maersk said it continues to cut costs at Transport & Logistics while lower fuel prices also helped offset some of the weakness.