Property investment, management, and development company Hongkong Land Holdings Limited has just paid a record price for a piece of land located in Shanghai. The real estate developer reportedly paid $4.43 billion for the property located in the West Bund area within the city of Shanghai.

According to a statement released the company, which a unit of Jardine Matheson Holdings, it plans to fully develop the property and put up office buildings, high-rise apartments, and shopping centers. All-in-all the property is expected to produce close to 1.94 billion square feet of office, commercial, and residential space.

The amount of money paid by one of Asia's longest established property companies has set a new record for Shanghai's commercial real estate market. The $4.43 billion purchase managed to surpass the $3.55 billion paid by China Minsheng Investment Group for a parcel of land in Dongjiadu in Shanghai in 2014.

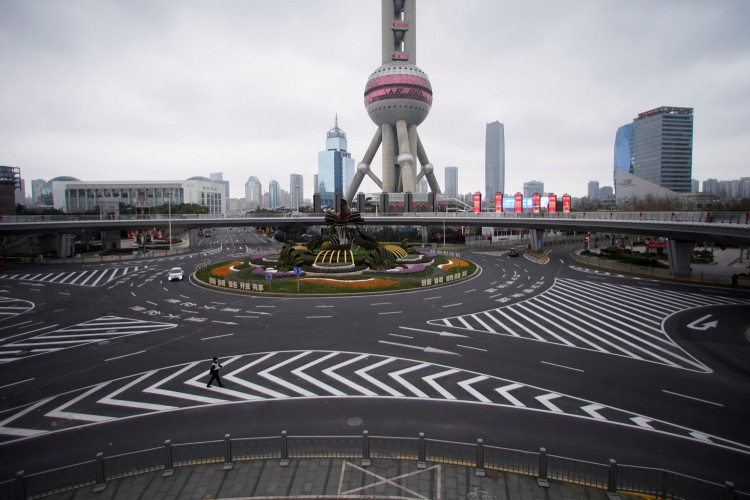

The massive investment made by Hongkong Land Holdings comes as the city is gripped by the recent viral outbreak, which has placed massive uncertainty on the country's real estate market. Industry experts have stated that the deal should bolster confidence for both developers and buyers, given how it signals possible increased activity in the market after the viral epidemic is placed under control.

The purchase is also expected to increase confidence in Shanghai's slumping housing market, which had been hit hard by the recently imposed caps on soaring home prices. While most developers are holdings on to their money for the time being given the current situation, Hongkong Land has shown initiative by investing in more lucrative projects, indicating that it expects the economic impact of the viral outbreak to be short-lived.

Hongkong Land currently has 20 major projects in major Chinese cities such as Beijing, Shanghai, Chongqing, Chengdu, and Hangzhou. This includes iconic buildings such as the Landmark in Hong Kong's central business district. The company also has major projects in Singapore, with a total area of 165,000 square meters. In total, the company's projects yield around 3.5 million square meters of mixed-use space.

The company, which was founded in 1889, is currently listed on several exchanges, namely on the London Stock Exchange as its primary listing and in Singapore and Bermuda as its secondary listings.

Apart from Hongkong Land, other Chinese property developers have also started making major investments in Shanghai. In 2013, Sun Hung Kai Properties paid around $3.08 billion for a piece of land in Shanghai's Xujiahu district, a location prime for shopping and entertainment establishments.